Bitcoin Price Eyes 15% Gains But Traders Say BTC Could Drop to $115K First

Key takeaways:

-

A Bitcoin price pullback to $115,000 is possible before continuing the uptrend.

-

A bull pennant suggests that the BTC price could rally by 15% to new highs above $136,000.

Bitcoin (BTC) price has spent most of the week pinned below $120,000, which many analysts have labelled as a key resistance zone. However, a new technical setup suggests that BTC is likely consolidating within a bull pennant before resuming its uptrend.

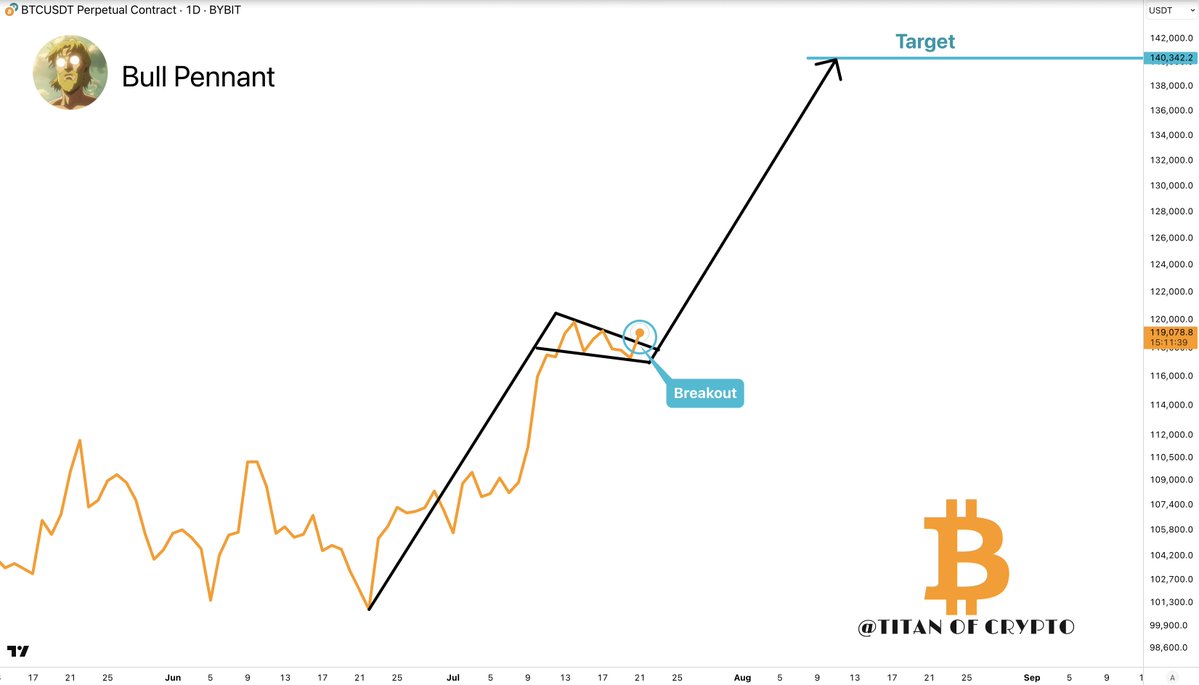

Bitcoin “bull pennant” targets $136,000 and beyond

Bitcoin rallied by 14% between July 8 and Saturday to reach an all-time high of nearly $123,000. Since then, BTC price has pulled back, consolidating between the all-time high and $115,000.

The latest data from Cointelegraph Markets Pro and TradingView shows BTC trading inside a bull pennant, suggesting that the final “explosive phase” is next.

Bitcoin is in a “bull pennant breakout targeting $140,000,” said popular crypto trader Titan of Crypto in a Monday post on X.

Related: Bitcoin bull run ‘likely close to over’ says trader as XRP flips McDonald’s

A bull pennant is a continuation pattern that occurs after a significant rise, followed by a consolidation period at the higher price end of the range.

“Welcome to the final and most explosive phase of the bull run.”

A positive breakout from the pennant could potentially lead to the next leg up for Bitcoin, measured at $136,500 or 15% from its current price level.

It is important to note that the success rate of a bull pennant is only around 54%, which makes it one of the least reliable patterns.

However, another classic pattern was spotted by Merlijn The Trader, a Bitcoin analyst, who says a BTC price target of $140,000 is in play based on an inverted head-and-shoulders pattern on the three-day chart.

“The breakout is real. Momentum is undeniable. $140K is the measured target.”

Other projections are a bit more ambitious, with one analyst citing a daily chart golden cross projecting BTC price to $155,000.

Popular trader Marcus Corvinus made a modest prediction, saying a symmetrical triangle breakout targets $125,000.

Bitcoin could drop to test support first

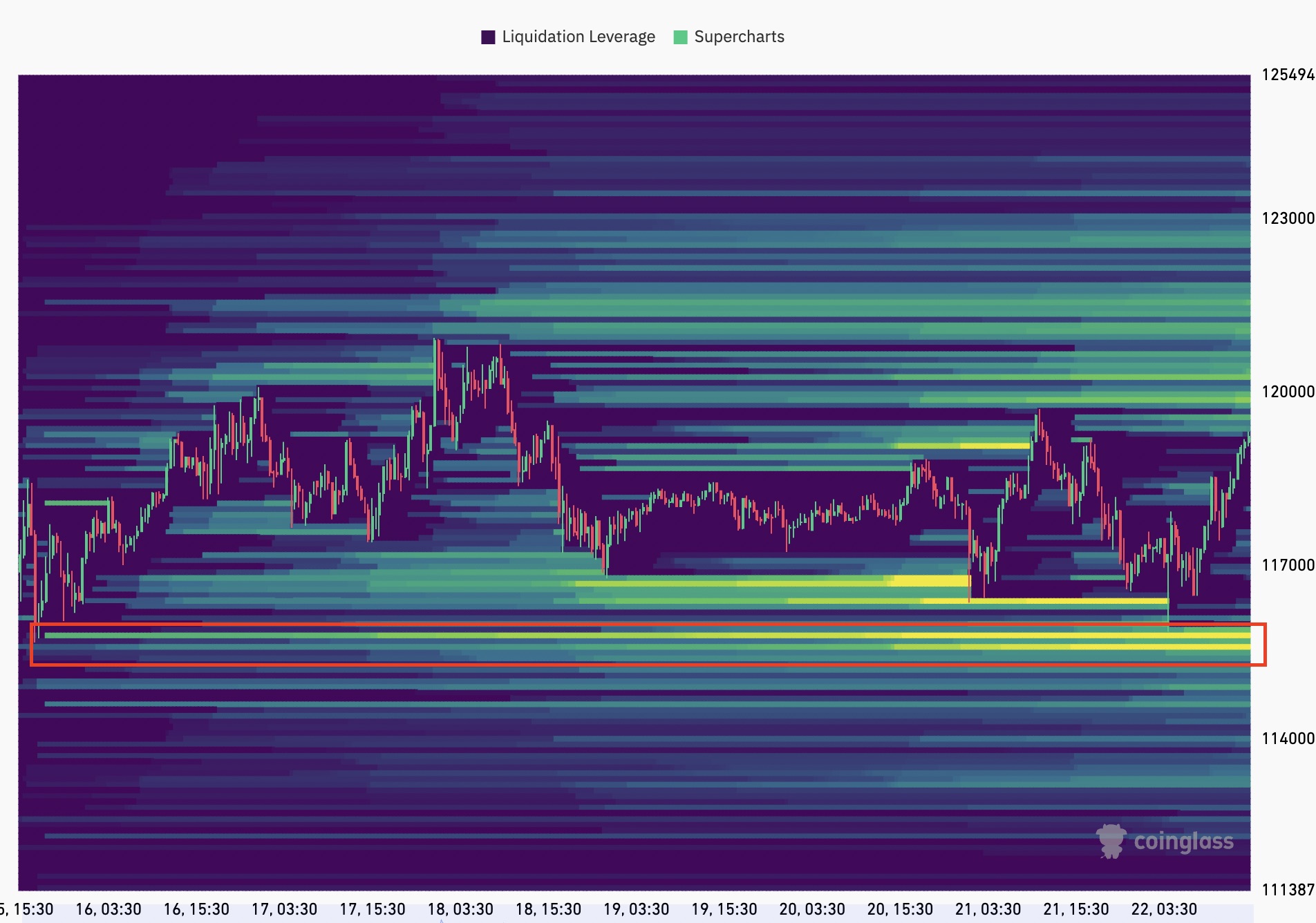

With the bulk of Bitcoin’s apparent sell-side liquidity absorbed during the move to $122,000, some analysts warn that a brief flush down to test $115,000 as support could be the next move for BTC price.

“Weekend low liquidity swept!” Popular analyst AlphaBTC said that Bitcoin could drop a little lower to grab the liquidity at around $115,000.

The BTC liquidity map shows that the order book is priming for that, with bid clusters stacked between $115,000 and $116,100.

“ A little lower and bulls will likely have the fuel needed to push higher once again.”

Fellow analyst Daan Crypto Trades said BTC price has stalled near its all-time high and noted that the bulk of the volume has been traded around $118,000, which is the middle level of the current range.

The analyst told his followers to watch the range low at $115,000 as support and the range high at $121,000 as resistance.

“Keep an eye out for these local highs and lows for a potential liquidity sweep.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Sui

Sui  Stellar

Stellar  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Avalanche

Avalanche  Ethena USDe

Ethena USDe  Toncoin

Toncoin  LEO Token

LEO Token  Litecoin

Litecoin  WETH

WETH  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Pepe

Pepe  Cronos

Cronos  Aave

Aave  Dai

Dai  Ethena

Ethena  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Aptos

Aptos  OKB

OKB  Pi Network

Pi Network  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  USD1

USD1  Pudgy Penguins

Pudgy Penguins  Binance-Peg WETH

Binance-Peg WETH  Gate

Gate  Algorand

Algorand  Bonk

Bonk  Arbitrum

Arbitrum  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Render

Render  sUSDS

sUSDS  Story

Story  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Sky

Sky  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Rocket Pool ETH

Rocket Pool ETH  Sei

Sei  Lombard Staked BTC

Lombard Staked BTC  Filecoin

Filecoin  Quant

Quant  USDtb

USDtb  SPX6900

SPX6900  USDT0

USDT0  Jupiter

Jupiter  KuCoin

KuCoin  StakeWise Staked ETH

StakeWise Staked ETH  NEXO

NEXO  Liquid Staked ETH

Liquid Staked ETH  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Stacks

Stacks  Injective

Injective  Falcon USD

Falcon USD  Celestia

Celestia  Solv Protocol BTC

Solv Protocol BTC