Key Bitcoin Price Levels To Watch as BTC Rally Stalls at $110K

Key takeaways:

-

Bitcoin’s multiple rejections from $110,000 signal the bulls’ inability to sustain higher prices.

-

BTC price may drop as low as $105,000 in the short term if key levels are lost.

Bitcoin (BTC) bulls were thwarted in an attempt to regain support at $110,000 on Thursday as US employment data exceeded expectations, dealing a blow to hopes of interest-rate cuts before September.

This is the third failed attempt since the May all-time high, casting doubt on Bitcoin’s ability to breach $110,000 and enter price discovery again.

Bitcoin price risks a deeper correction

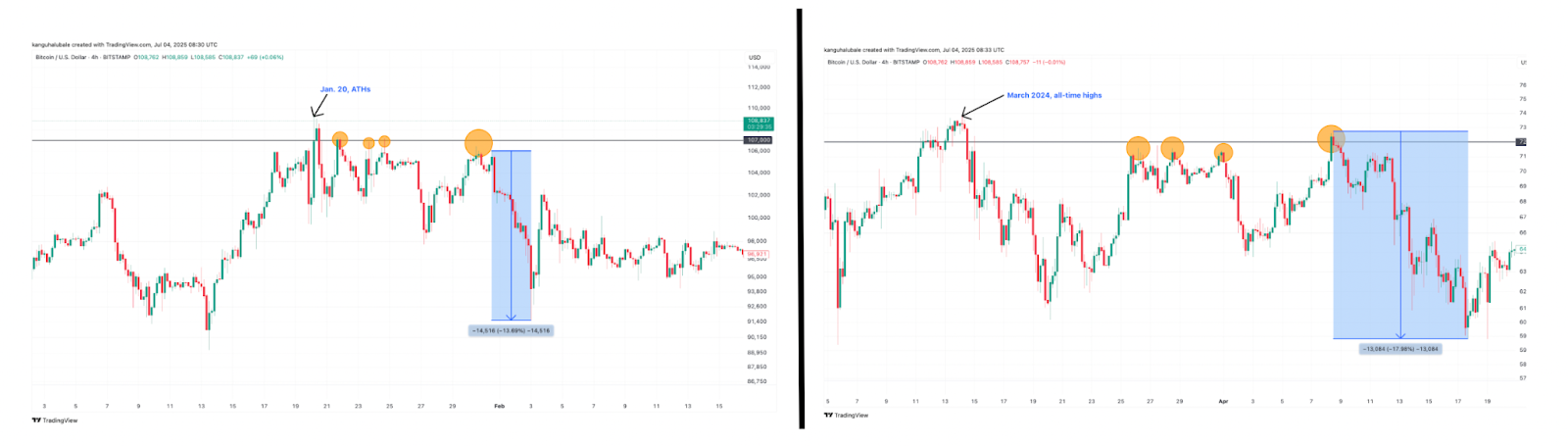

Historically, multiple rejections near all-time highs have preceded sharp drops in BTC price.

For example, Bitcoin price was rejected multiple times from the $107,000 level in January, just 2% below the previous all-time high above $109,000 reached on Jan. 20. This preceded a 14% price drop over the two weeks that followed.

Related: Bitcoin bull run could peter out in 2-3 months, says analyst

Similarly, BTC price plunged 18% within 10 days following multiple rejections from the $72,000 resistance level, close to the earlier $73,800 record high of March 14, 2024.

If history repeats, the BTC/USD pair will drop 14%-18% from current price levels.

Technical indicators like bearish divergences in the relative strength index, where the price makes higher highs but RSI forms lower highs, reinforce the resistance at $110,000.

Additionally, high-taker sell volume around $110,000 and neutral funding rates in futures markets point to profit-taking and hesitation among traders, increasing the likelihood of a pullback.

Taker Sell Orders starting to rumble on this headline 🩸 https://t.co/JUy3LuH9nF pic.twitter.com/ZJrr9qNflT

— Maartunn (@JA_Maartun) July 3, 2025

Key Bitcoin price levels to watch under $110,000

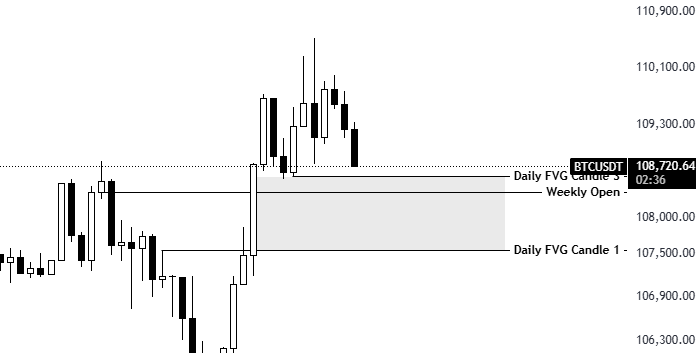

Data from Cointelegraph Markets Pro and TradingView shows Bitcoin price trading at $109,100, as $110,000 remains a key barrier. The BTC/USD pair needs to achieve a clear break above this level to end the multimonth consolidation.

Above that, there is a major supply zone stretching from $110,000 to $112,000, which the bulls must also overcome to get back into price discovery.

Conversely, the bears will attempt to defend the $110,000 resistance, increasing the likelihood of pulling the price lower.

A key area of interest lies between $107,500, where the 50-day simple moving average (SMA) currently sits, and $106,000, where the 100-day and 200-day SMAs appear to converge.

Another area of interest stretches from the local low at $105,200 (reached on Wednesday) to the $104,000 psychological level.

Pseudonymous trader KillaXBT points out that Bitcoin could see a deeper correction if it loses the support between $108,000 and $107,500. The trader also said that holding this area would see BTC rally to fresh all-time highs over the next few weeks.

“Hold = I TP my short and aim for a sweep of ATH this month.”

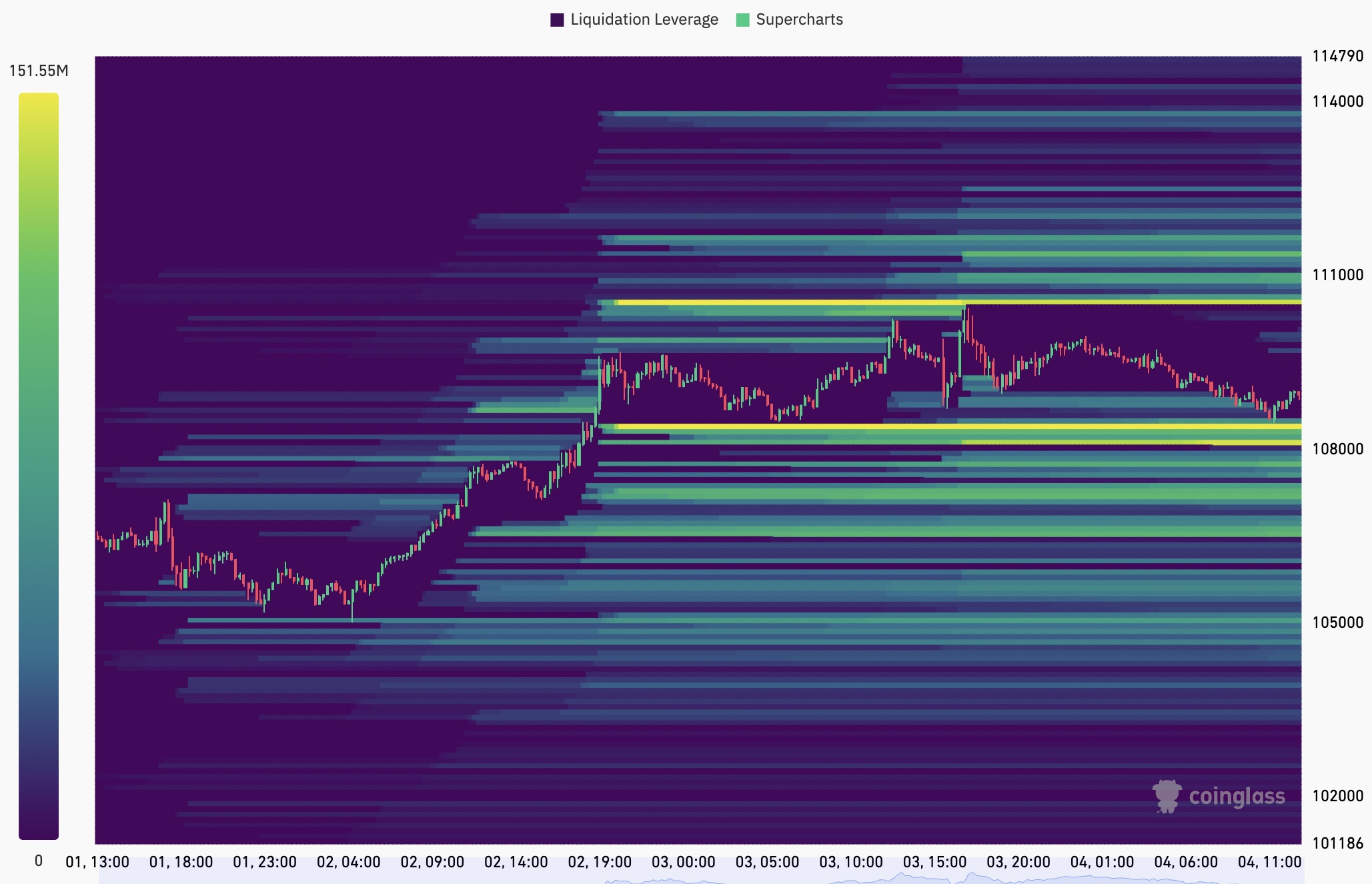

The BTC/USDT three-day liquidation heatmap shows the biggest liquidity cluster of $121 million, sitting just above $110,000, as per data from CoinGlass.

A short squeeze is therefore in play if the $110,000 level is broken, which could force short sellers to close positions and drive prices toward $114,000.

On the downside, heavy bid orders are sitting around $108,000, with the next significant cluster bands in place from $107,700 to $105,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Sui

Sui  Stellar

Stellar  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Avalanche

Avalanche  Ethena USDe

Ethena USDe  Toncoin

Toncoin  Litecoin

Litecoin  LEO Token

LEO Token  WETH

WETH  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Pepe

Pepe  Cronos

Cronos  Aave

Aave  Dai

Dai  Ethena

Ethena  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Aptos

Aptos  OKB

OKB  Pi Network

Pi Network  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  USD1

USD1  Pudgy Penguins

Pudgy Penguins  Binance-Peg WETH

Binance-Peg WETH  Gate

Gate  Algorand

Algorand  Bonk

Bonk  Arbitrum

Arbitrum  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Render

Render  sUSDS

sUSDS  POL (ex-MATIC)

POL (ex-MATIC)  Story

Story  Worldcoin

Worldcoin  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Sky

Sky  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Rocket Pool ETH

Rocket Pool ETH  Filecoin

Filecoin  Lombard Staked BTC

Lombard Staked BTC  Sei

Sei  Quant

Quant  USDtb

USDtb  SPX6900

SPX6900  USDT0

USDT0  Jupiter

Jupiter  KuCoin

KuCoin  StakeWise Staked ETH

StakeWise Staked ETH  NEXO

NEXO  Liquid Staked ETH

Liquid Staked ETH  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Stacks

Stacks  Injective

Injective  Falcon USD

Falcon USD  Celestia

Celestia  Solv Protocol BTC

Solv Protocol BTC