XRP Mirrors 70% Rally Fractal as Price Nears Falling Wedge Breakout

Key takeaways:

-

XRP is mirroring a bullish fractal that led to a 70% rally earlier this year.

-

Price eyes a 20% breakout from a falling wedge, targeting $3.75 in August.

-

XRPL growth and stablecoin activity bolster the case for a move toward $4.

XRP’s (XRP) latest price action is echoing a bullish fractal from earlier this year, raising the prospect of a strong upside continuation in August.

XRP falling wedge hints at 20% rally in August

Between December and January, XRP consolidated inside a falling wedge pattern while holding firm above its 50-day exponential moving average (50-day EMA; the red wave).

The pattern resolved with a breakout to the upside in early January, reclaiming the 20-day EMA (the purple wave) as support and fueling a 70% price surge — from around $2 to above $3.39 — within weeks.

As of August, XRP is once again consolidating within a falling wedge after a steep rally, while bouncing from its 50-day EMA and flipping the 20-day EMA back into support.

In both cases, XRP’s relative strength index (RSI) pulled back sharply from overbought levels and stabilized near 50, a reset that preceded a breakout in January.

The similarities between the two patterns suggest that XRP could be on the verge of another strong move upward.

As of Tuesday, the cryptocurrency is testing the wedge’s upper trendline for a potential breakout toward $3.75, up by over 20% from the current price levels, in August.

A rejection at the upper trendline could delay the breakout, with XRP likely retesting the 50-day EMA as support. A close below this level risks a drop toward the wedge apex near the 200-day EMA around $2.34.

Some analysts expect XRP to break above $4 this cycle, owing to whale accumulation and a potential Federal Reserve rate cut in September that may fuel risk appetite overall.

Related: Bitcoin rejects at $116K despite US jobs win as Fed rate cut bets pass 75%

XRP’s fundamentals remain robust

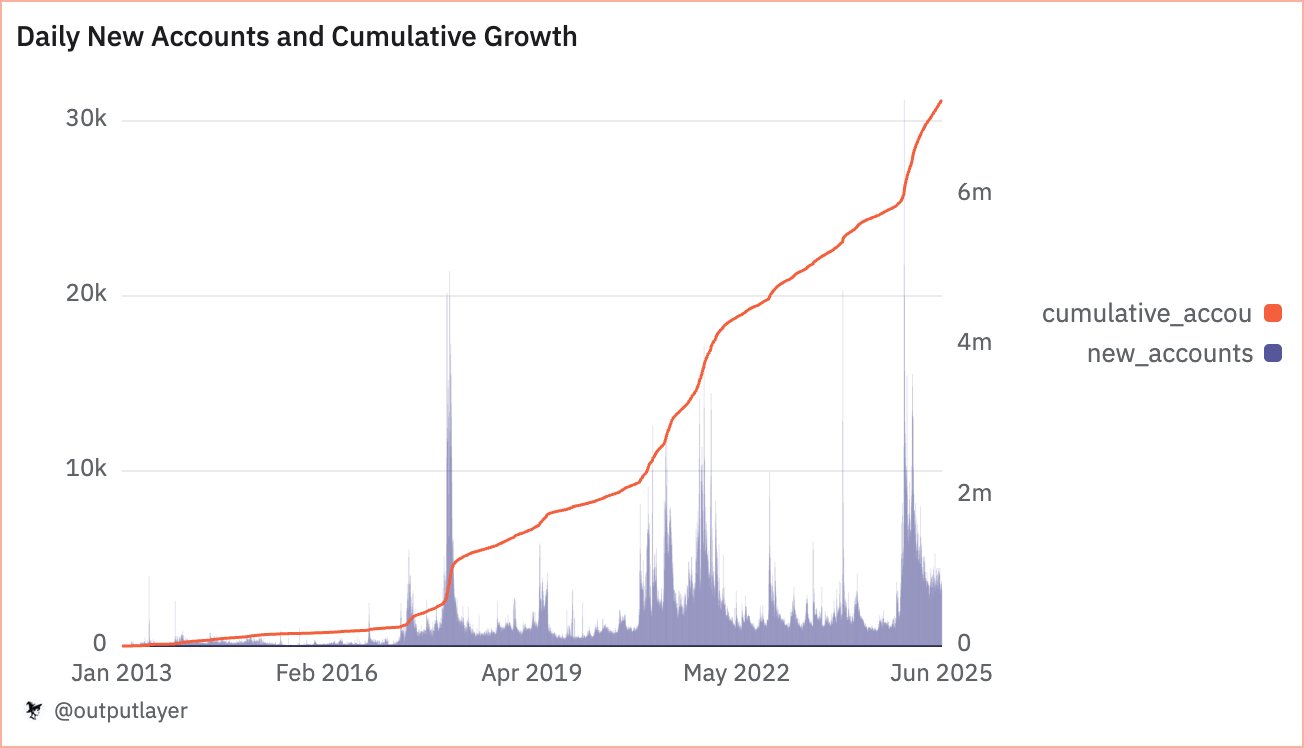

Ripple’s XRP Ledger processed over 70 million transactions in July 2025, while more than 1 million new accounts have been created this year, according to data resource Dune Analytics.

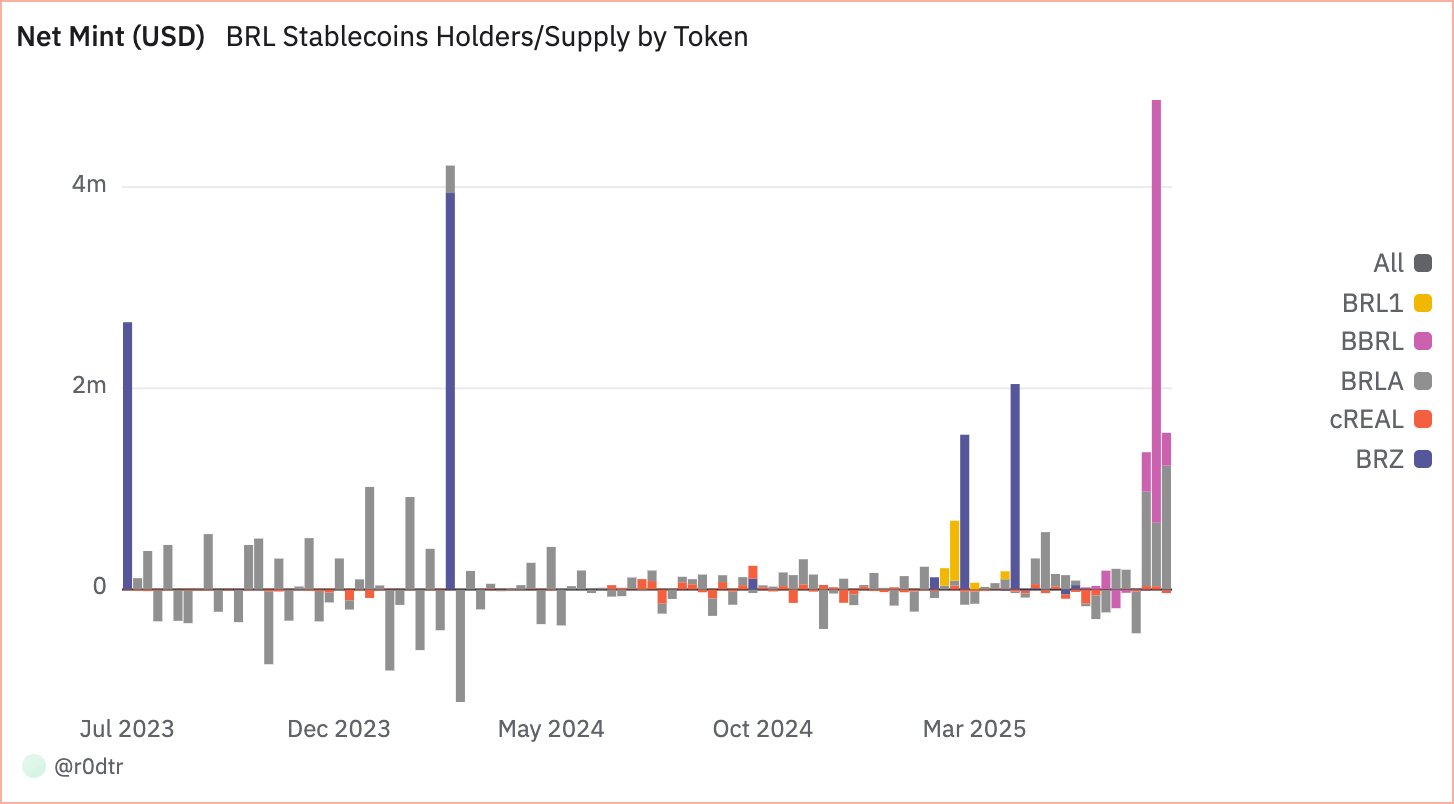

XRPL’s stablecoins have been a major part of its network growth.

In Brazil, Braza Bank issued over $4.2 million worth of its BBRL stablecoin on XRPL in July, making it the second-largest BRL stablecoin after Transfero Group’s BRZ.

In the US, activity around Ripple’s RLUSD has surged, with daily transfers rising from about 5,000 to over 12,000 within one month.

XRPL’s growing stablecoin activity and user adoption strengthen its utility narrative, reinforcing bullish sentiment that could support XRP’s rally toward the $3.75-4.00 range.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Stellar

Stellar  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Litecoin

Litecoin  WETH

WETH  LEO Token

LEO Token  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Polkadot

Polkadot  Monero

Monero  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Cronos

Cronos  Pepe

Pepe  Ethena

Ethena  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Mantle

Mantle  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Pi Network

Pi Network  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Binance-Peg WETH

Binance-Peg WETH  USD1

USD1  Pudgy Penguins

Pudgy Penguins  Algorand

Algorand  Arbitrum

Arbitrum  Gate

Gate  VeChain

VeChain  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Bonk

Bonk  Render

Render  sUSDS

sUSDS  Story

Story  Worldcoin

Worldcoin  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Rocket Pool ETH

Rocket Pool ETH  Sei

Sei  Sky

Sky  Filecoin

Filecoin  Lombard Staked BTC

Lombard Staked BTC  SPX6900

SPX6900  Jupiter

Jupiter  USDtb

USDtb  StakeWise Staked ETH

StakeWise Staked ETH  USDT0

USDT0  KuCoin

KuCoin  Liquid Staked ETH

Liquid Staked ETH  Injective

Injective  Mantle Staked Ether

Mantle Staked Ether  NEXO

NEXO  Curve DAO

Curve DAO  Stacks

Stacks  Celestia

Celestia  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Falcon USD

Falcon USD  Renzo Restaked ETH

Renzo Restaked ETH  Optimism

Optimism