How Unbank Built a Lightning-Powered Bitcoin App

When most people think of Bitcoin ATMs, they picture clunky machines with high fees and slow transactions. Emilio Pagan-Yourno, CEO/COO of Unbank, is working to change that perception entirely.

His company has been quietly improving the Bitcoin ATM space since 2014, and the company has recently expanded beyond its Bitcoin ATM roots and now offers an enhanced mobile app with Lightning Network integration, making buying and selling bitcoin with Unbank that much easier.

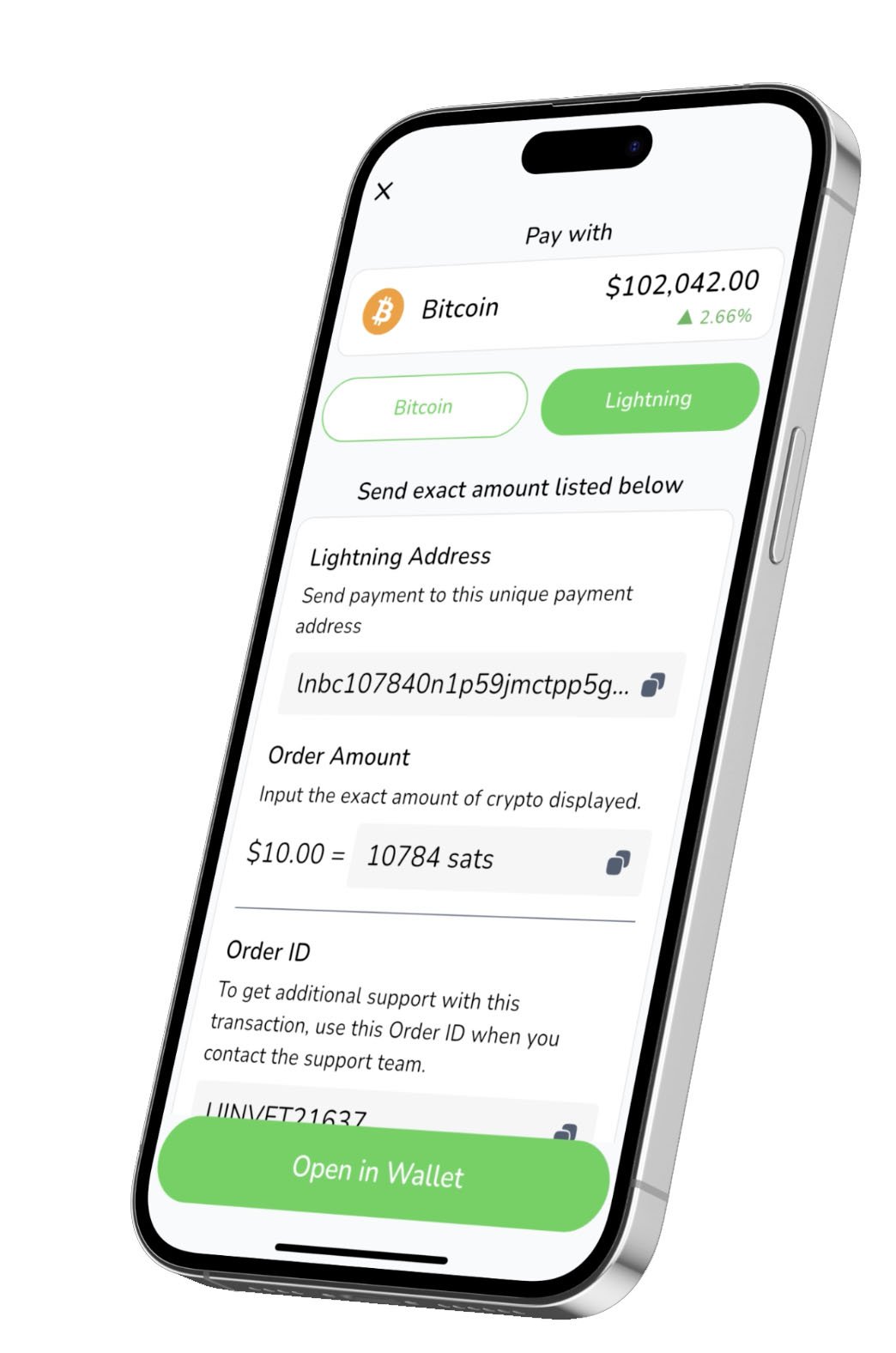

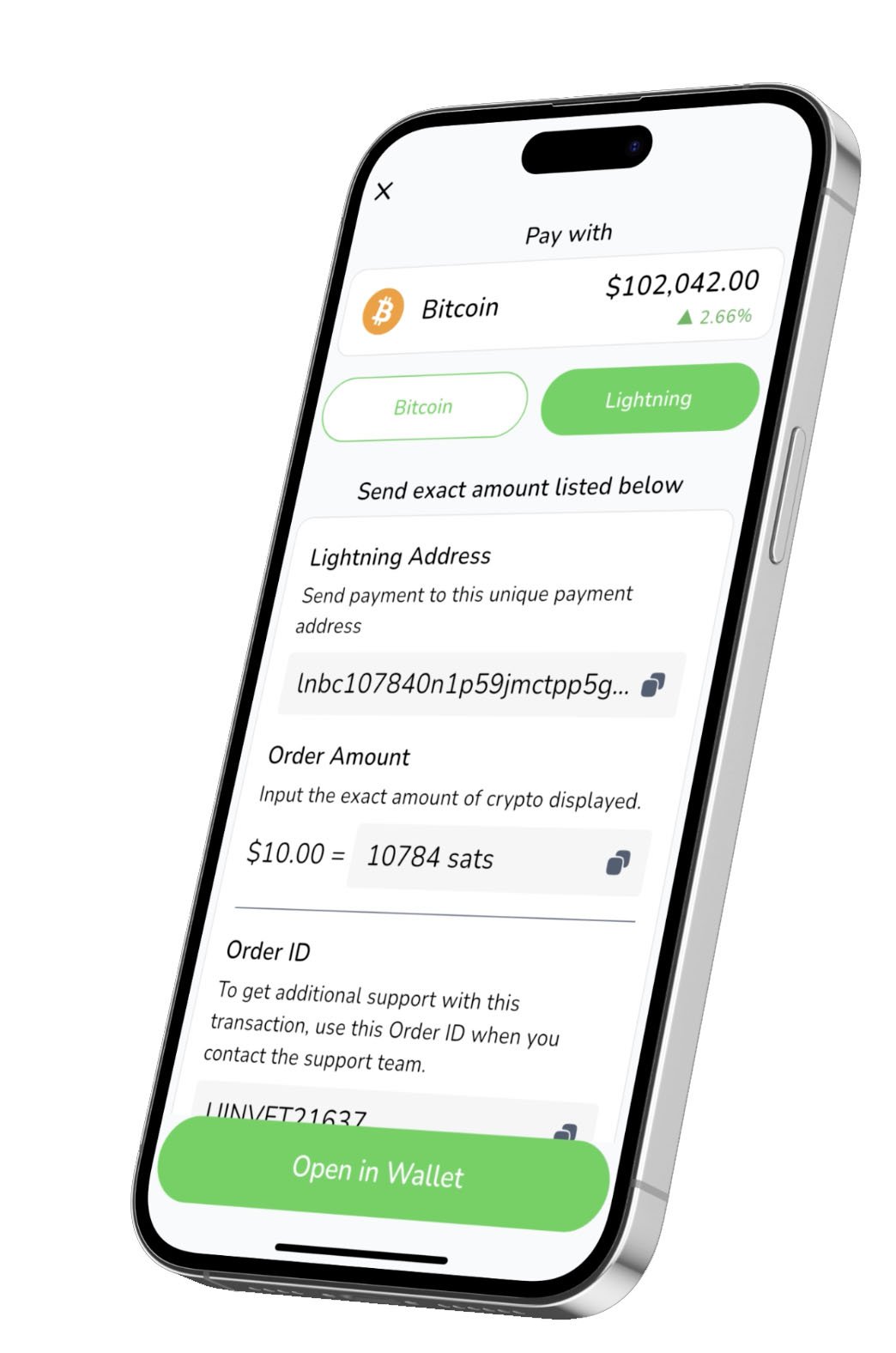

“We finally got integrated with Lightning using Voltage for our infrastructure, which is great,” Pagan-Yourno explains. “They provide a really nice infrastructure for us to utilize and accept Lightning payments as well as send them out to our customers when they purchase bitcoin.”

One of the things that makes Unbank’s mobile approach particularly smart is its non-custodial design. “We don’t hold customer funds,” Pagan-Yourno said.

To improve speed and reliability, Unbank has integrated the Lightning Network, enabling instant transactions when it’s used.

He highlighted this, saying, “if someone wants to sell, they might have to wait for that block confirmation with traditional methods, whereas with Lightning, it’s instant.”

By leveraging their internal systems and lightning on top of that, they are able to provide a fast, clear and dependable user experience.

Here’s how it works: when customers want to sell, Unbank generates an invoice through their BTCPay Server.

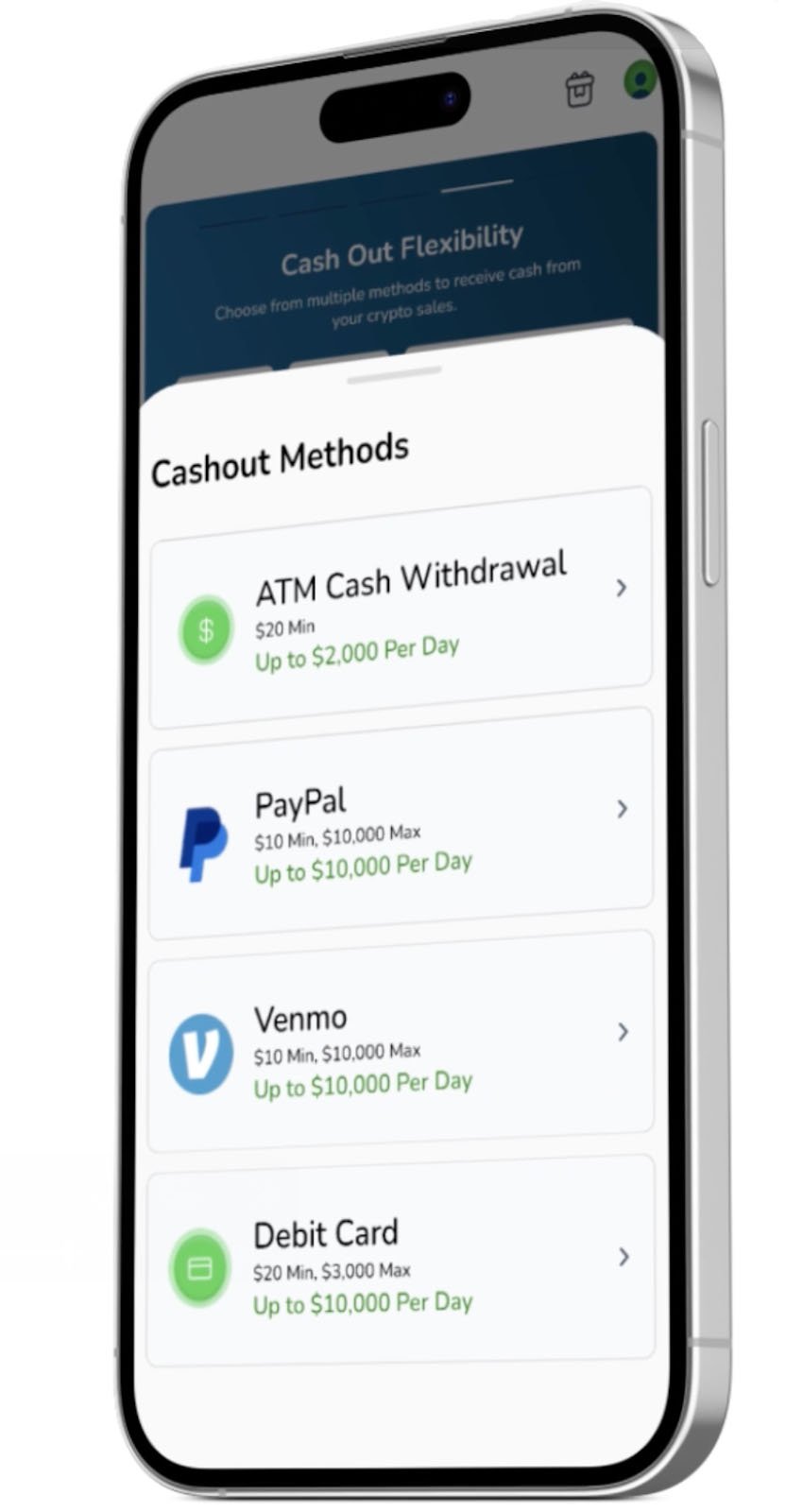

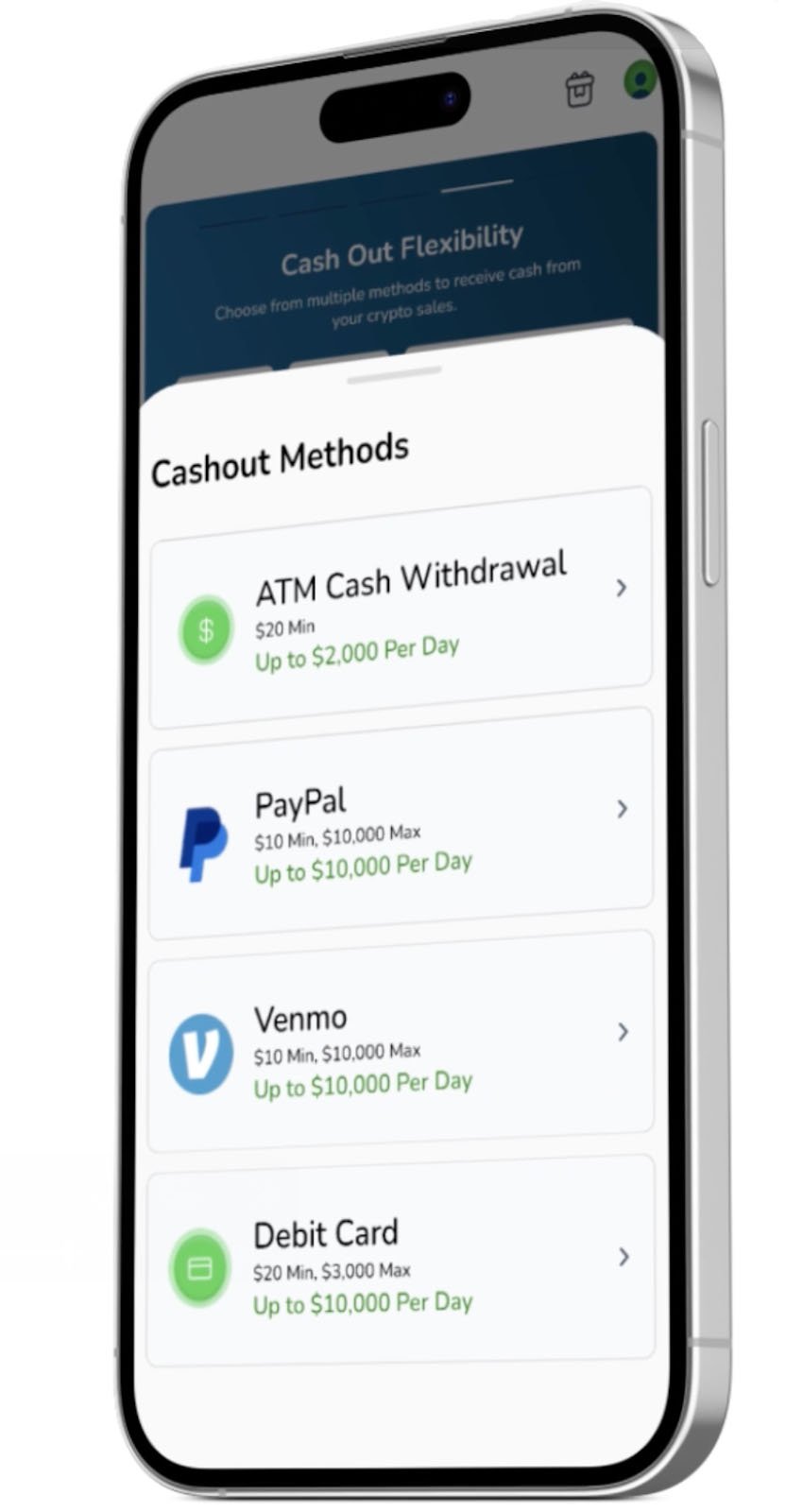

Customers pay that Lightning invoice, and instantly receive either cash at CVS/Walgreens ATMs or direct bank transfers via their “push to card” option. No pre-funding accounts, no waiting periods, just instant peer-to-peer bitcoin sales.

The app has seen impressive Lightning transaction volumes, with customers conducting layer-two transactions as large as $2,300.

“A lot of our customers use us for selling bitcoin to get some cash to pay their rent at the end of the month,” Pagan-Yourno notes, highlighting real-world Bitcoin use that goes beyond speculation.

The mobile app’s instant payment system seamlessly connects to their broader infrastructure so customers can cash out easily, all initiated through the Lightning-powered mobile experience.

It’s this integration of mobile Lightning capabilities with real-world cash access that sets Unbank apart in an increasingly crowded field.

Beyond ATMs: Building Community

Unbank recently launched a referral rewards program in their mobile app after customers complained about bringing in new users without any incentive.

“A lot of times customers would complain that they’re giving us a lot of new customers and they’re not getting anything out of it,” Pagan-Yourno admits honestly. The solution? A straightforward $10 reward for both the referrer and new customer upon their first transaction.

While simple, Pagan-Yourno hints at future evolution: “We might change that up to be more of a volume-based reward based on how much the referred customer actually does in volume.”

The AI Revolution Meets Bitcoin

Like many Bitcoin entrepreneurs, Pagan-Yourno is watching the AI revolution with keen interest. While Unbank hasn’t fully embraced AI for core operations due to security concerns, they’ve experimented with it for UI/UX design and research.

“We’ve used it a little on the UI/UX side,” he explains. “For Figma designs and things like that, as well as research and thinking up new ways to have different processes in place.”

It will be interesting to watch the impact AI could have on Lightning payments.

Could AI agents use bitcoin for microtransactions? “I think it would be a good use case for AI to make little microtransactions to each other,” Pagan-Yourno agrees, though he acknowledges the deflationary concerns some have raised.

His take on spending valuable bitcoin? “I could make the case that I wasted a ton of sats back in the day on stupid stuff, right? But it’s always going to be like that. That’s just the cost of spending or utilizing very valuable currency like bitcoin.”

Bitcoin Treasury Companies

When asked about the recent wave of bitcoin treasury companies, Pagan-Yourno offers a perspective that many Bitcoiners share: “I love the idea of these companies holding bitcoin on their balance sheets… but would I invest in a company just because they have a bitcoin balance sheet? Probably not.”

His reasoning is simple: “Why would I invest in a company that could fail when I could invest in bitcoin which in my heart, I don’t think it will fail? Companies fail, Bitcoin doesn’t fail. So why would I invest in the company when I can invest in bitcoin?”

It’s a perspective that resonates with many individual Bitcoiners who have direct access to spot bitcoin.

While these treasury companies serve an important function, providing bitcoin exposure to pension funds, 401(k)s, and other institutional capital that can’t buy bitcoin directly, they can also add unnecessary complexity for some retail investors who FOMO in without doing their own research first.

The arbitrage opportunity these companies exploit is real and valuable for certain pools of capital.

But for individuals who can simply open a wallet and buy bitcoin directly, Pagan-Yourno’s message is clear: why add layers of corporate risk when you can own the hardest money ever created outright?

Expanding Horizons: Latin America Beckons

Looking ahead, Unbank has ambitious expansion plans. “We’re definitely looking to expand into other markets, which is kind of exciting. And that’s most likely going to be the Latin America region,” Pagan-Yourno reveals.

The choice is strategic. “I speak Spanish and a lot of my team members speak Spanish. So it would be the easiest market, besides maybe Canada.”

The Latin American expansion could be perfectly timed for stablecoin adoption. Pagan-Yourno is particularly excited about the potential for Tether on the Lightning Network.

“Tether on Lightning would be really nice because right now a lot of people in Latin America use USDT on Tron… if we can get it on Bitcoin and get it instant and obviously a lot cheaper than Tron, I think it’ll become the standard over there,” he said.

The Fighting Fraud Battle

Operating in the Bitcoin space means constant vigilance against scams, especially those targeting elderly users. Unbank has implemented additional security measures in several states to prevent scams where bad actors trick elderly people into sending bitcoin to external wallets.

“There are state laws now that do make cash reversible in some states,” Pagan-Yourno explains. “So we have to take extra measures to make sure that customers are sending to their own wallet, not someone else’s wallet to avoid potential scams.”

It’s a sobering reminder that Bitcoin’s irreversible nature, while extremely powerful, requires education and protection measures for vulnerable users.

Conclusion

As Bitcoin continues its march toward mainstream adoption, companies like Unbank are building the infrastructure that will make that future possible.

Their combination of Lightning Network integration, non-custodial operations, and practical focus on real-world use cases, positions them well for what’s coming.

“I think the world’s going to look vastly different five years from now,” Pagan-Yourno reflects, echoing the sentiment many feel about the rapid pace of change in both AI and Bitcoin.

With plans for Latin American expansion and continued innovation in Lightning-powered financial services, Unbank is riding the Bitcoin wave, and helping to build it, one instant transaction at a time.

For more information about Unbank, follow them on X/Twitter @unbankworld or visit their website at unbank.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Hyperliquid

Hyperliquid  Sui

Sui  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Litecoin

Litecoin  LEO Token

LEO Token  WETH

WETH  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Monero

Monero  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Pepe

Pepe  Cronos

Cronos  Aave

Aave  Ethena

Ethena  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  OKB

OKB  Pi Network

Pi Network  Mantle

Mantle  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Pudgy Penguins

Pudgy Penguins  Binance-Peg WETH

Binance-Peg WETH  USD1

USD1  Algorand

Algorand  Bonk

Bonk  Arbitrum

Arbitrum  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Render

Render  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  sUSDS

sUSDS  Official Trump

Official Trump  Story

Story  Binance Staked SOL

Binance Staked SOL  Sky

Sky  Rocket Pool ETH

Rocket Pool ETH  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Sei

Sei  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Filecoin

Filecoin  Quant

Quant  SPX6900

SPX6900  Lombard Staked BTC

Lombard Staked BTC  Jupiter

Jupiter  USDtb

USDtb  StakeWise Staked ETH

StakeWise Staked ETH  USDT0

USDT0  KuCoin

KuCoin  NEXO

NEXO  Liquid Staked ETH

Liquid Staked ETH  Injective

Injective  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Stacks

Stacks  Celestia

Celestia  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Renzo Restaked ETH

Renzo Restaked ETH  Falcon USD

Falcon USD