Decentralized Finance (DeFi) Market Top Companies Study – Compound Labs, Inc.; Maker DAO; Agave; Unisa; Sushi Swap; Curve Finance.

Decentralized Finance (DeFi) Market

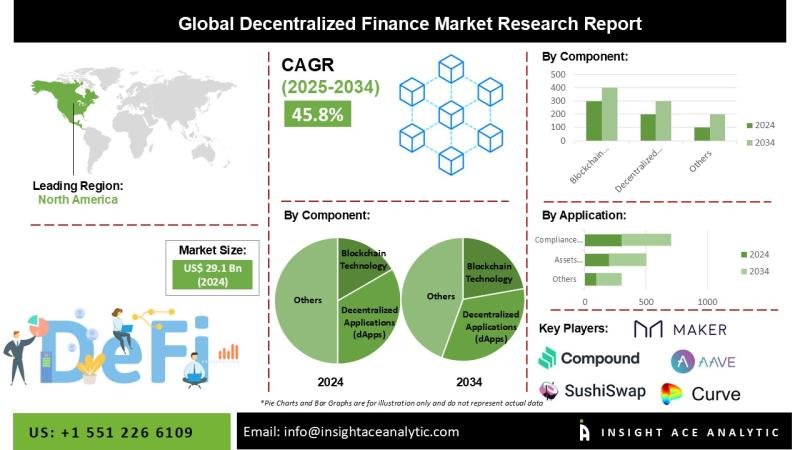

“Decentralized Finance (DeFi) Market” in terms of revenue was estimated to be worth USD 29.1 Billion in 2024 and is poised to reach USD 1250.7 Billion by the year 2034, growing at a 45.8% CAGR from 2025 to 2034 according to a new report by InsightAce Analytic.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/1607

Latest Drivers Restraint and Opportunities Market Snapshot:

Key factors influencing the global Decentralized Finance (DeFi) Market are:

• Technological advancement

• Dominant financial organizations

• Popularity as blockchain genres

The following are the primary obstacles to the Decentralized Finance (DeFi) Market ‘s expansion:

• Risk to security

• Concerns regarding regulations

• Lack of awareness

Future expansion opportunities for the global Decentralized Finance (DeFi) Market include:

• Safety and openness

• International wire transfer

• Accelerating research and development efforts

Market Analysis:

The financial sector has experienced a profound shift with the rapid adoption of Decentralized Finance (DeFi), which has emerged as a major catalyst for market growth. The convergence of DeFi with decentralized blockchain technologies has garnered considerable momentum in recent years. Looking forward, the emergence of blockchain-based prediction platforms is anticipated to unlock additional opportunities for market development and diversification.

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

List of Prominent Players in the Decentralized Finance (DeFi) Market:

• Cognizant

• Compound Labs, Inc.

• MakerDAO

• Aave

• Uniswap

• SushiSwap

• Curve Finance

• Synthetix

• Balancer

• Bancor Network

• Badger DAO

Recent Developments:

• In January 2024, Marker DAO activated GHO, the native decentralized over-collateralized asset of the Aave Protocol, after approving and executing the proposal. Launched on the Ethereum Mainnet, GHO allows users to mint GHO on the Aave Protocol’s Ethereum V3 market using collateral they have previously supplied.

• In November 2023, BadgerDAO concentrated on developing the eBTC protocol and completed it. Additional audits were conducted traditional audits were conducted to ensure eBTC was secure, and Badger Treasury continued producing positive returns in Q3. Still, the decline in DeFi yields has reduced the size of such returns.

• In October 2023, Bancor introduced decentralized finance (DeFi); the Arb Fast Lane was one of the most significant breakthroughs in the field. As the pioneering protocol of its kind, it facilitates arbitrage across many decentralized exchanges (DEXes) by offering a unique blend of accessibility and intricacy.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/1607

Decentralized Finance (DeFi) Market Dynamics

Market Drivers: Increasing Adoption of Blockchain Technology

The rising adoption of blockchain technology is a primary driver of growth in the decentralized finance (DeFi) market. DeFi enhances transparency and operational efficiency by enabling real-time access to financial transactions and data on decentralized networks. Unlike traditional financial systems, DeFi platforms offer users the ability to independently audit and verify transactions, fostering greater trust and visibility. These platforms support a range of financial services, including decentralized lending, asset management, and investment decision-making. Sectors such as banking, retail, automotive, and media are increasingly leveraging DeFi to optimize performance, a trend expected to significantly contribute to market expansion over the forecast period.

Challenges: Regulatory Uncertainty

Despite its growth potential, the DeFi market faces challenges stemming from regulatory uncertainty and potential vulnerabilities within emerging technologies. Many DeFi protocols remain untested at scale, and gaps in smart contract security may lead to exploitation and financial losses. Additionally, the absence of clear regulatory frameworks in many jurisdictions creates legal ambiguity for DeFi projects. The potential introduction of restrictive compliance measures or prohibitions on specific DeFi activities may hinder innovation and limit broader market adoption.

Regional Trends: North America Expected to Lead Market Growth

North America is projected to dominate the DeFi market in terms of revenue and exhibit the highest compound annual growth rate during the forecast period. This growth is attributed to the region’s rapid adoption of advanced digital technologies and the presence of a robust ecosystem of blockchain-based enterprises. Key regional developments include the emergence of decentralized autonomous organizations (DAOs), increasing regulatory clarity, asset tokenization initiatives, and solutions addressing scalability concerns. Collectively, these factors position North America as a leading hub for DeFi innovation and expansion.

Segmentation of Decentralized Finance (DeFi) Market-

By Product-

• Blockchain Technology

• Decentralized Applications (DAPPS)

• Smart Contracts

By Application-

• Assets Tokenization

• Compliance & Identity

• Marketplaces & Liquidity

• Payments

• Data & Analytics

• Decentralized Exchanges

• Prediction Industry

• Stable coins

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/decentralized-finance-market/1607

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: http://www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Sui

Sui  Stellar

Stellar  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Avalanche

Avalanche  Ethena USDe

Ethena USDe  Toncoin

Toncoin  LEO Token

LEO Token  Litecoin

Litecoin  WETH

WETH  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Pepe

Pepe  Cronos

Cronos  Aave

Aave  Dai

Dai  Ethena

Ethena  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  OKB

OKB  Ondo

Ondo  Aptos

Aptos  Pi Network

Pi Network  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  USD1

USD1  Pudgy Penguins

Pudgy Penguins  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Gate

Gate  Bonk

Bonk  VeChain

VeChain  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  Render

Render  sUSDS

sUSDS  POL (ex-MATIC)

POL (ex-MATIC)  Story

Story  Worldcoin

Worldcoin  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Sky

Sky  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Rocket Pool ETH

Rocket Pool ETH  Filecoin

Filecoin  Lombard Staked BTC

Lombard Staked BTC  Quant

Quant  Sei

Sei  USDtb

USDtb  SPX6900

SPX6900  USDT0

USDT0  Jupiter

Jupiter  KuCoin

KuCoin  StakeWise Staked ETH

StakeWise Staked ETH  NEXO

NEXO  Liquid Staked ETH

Liquid Staked ETH  Mantle Staked Ether

Mantle Staked Ether  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Stacks

Stacks  Injective

Injective  Curve DAO

Curve DAO  Falcon USD

Falcon USD  Celestia

Celestia  Solv Protocol BTC

Solv Protocol BTC