Goldonline Launches Next-Generation CFD Trading Platform, Connecting to Global Financial Backbone

New York, NY, Aug. 04, 2025 (GLOBE NEWSWIRE) — Goldonline Global Ltd. today announced the full launch of its next-generation trading execution system, officially connecting to Equinix NY4, one of the world’s top financial data centers. This significant deployment marks a key milestone in Goldonline’s construction of critical nodes within the global financial infrastructure network, solidifying its ongoing leadership in the global Contracts for Difference (CFD) market with a more robust technological foundation.

Equinix NY4, located in New York, USA, is the highest connectivity hub for financial trading institutions, market makers, hedge funds, and exchanges. Regarded as the “heart of the global financial internet,” it aggregates over 800 financial service providers and liquidity providers, serving as a core platform for high-frequency trading and institutional matchmaking. Goldonline is one of the first licensed CFD platforms to fully access this data center, marking a new dimension of performance for its trading system.

Headquartered on Wall Street in New York, Goldonline has focused since its establishment in 2016 on building a “trusted, compliant, and intelligent” global financial trading operating system. The platform offers services across seven categories of CFD assets, including forex, precious metals, energy, commodities, and indices, providing global users with stable, compliant, and low-latency trading services.

Regulatory Strength Recognized

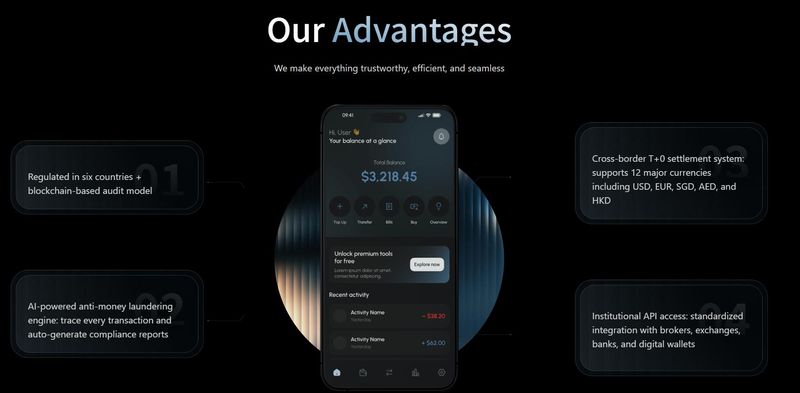

Goldonline has received registration approval as a Money Services Business (MSB) from the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury, as well as registration from the U.S. Securities and Exchange Commission (SEC). The company adheres to a development logic of “regulation first, technology as a foundation,” strictly implementing international financial compliance policies such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

The upgrade of the trading system and node deployment strictly follows the SEC’s core requirements for data security, trading transparency, and anti-manipulation, achieving true synchronization of technology and compliance.

“We are not just building a faster system; we are creating a standard channel for trustworthy global capital clearing.”

— Sophia Reed, Vice President of Technology at Goldonline

Millisecond-Scale Matching and Global Concurrent Trading Support

The newly released “G-Execution 2.0 System” by Goldonline is fully self-developed, featuring high-concurrency order matching, automatic slippage control, on-chain execution verification, intelligent latency adjustment, and dynamic liquidity switching, significantly enhancing the platform’s volatility resistance and execution quality.

After connecting to Equinix NY4, the overall matching speed of the platform has improved by over 40%, with the average order latency now reduced to under 15 milliseconds. Combined with the OneZero Bridge system, Goldonline has established stable direct connections with over ten top-tier liquidity providers globally, achieving deep order books and intelligent price matching, particularly suitable for high-frequency traders and quantitative strategy teams.

Additionally, the new system introduces AI behavior recognition risk control modules and on-chain audit records, providing verifiable audit trails for all transactions and supporting the generation of multi-country regulatory report formats, thus enhancing the platform’s regulatory technology capabilities.

Accelerating Global Strategy to Build a Ten-Nation Trading Compliance Network

According to official data, as of the second quarter of 2025, Goldonline’s average daily settlement processing volume has surpassed $1 billion, with managed assets (AUM) exceeding $34 billion and clients across over 40 countries and regions. The platform’s transaction success rate is 99.998%, and its system stability is leading in the industry.

Based on this NY4 node construction, the company is also planning the next phase of its global technology network layout, aiming to complete the deployment of ten global financial nodes, including London LD4, Singapore SG1, Frankfurt FR2, and Dubai DIFC, by 2026, forming a globally covered compliance clearing system and data service network.

Moreover, Goldonline will further accelerate its strategic expansion in the Asia-Pacific, Middle East, and Latin American markets, integrating local compliance policies and government regulatory sandbox programs to promote localized trading services, regulatory interface connections, and liquidity partnerships, advancing the integration of global capital markets and regulatory technology.

Chairman James W. Carter stated, “Compliance is the starting point, technology is the means, and trust is the goal. Goldonline will continue to leverage regulatory recognition, win users with system stability, and reshape the next generation of financial trading platforms through global connectivity.”

This system deployment not only significantly enhances Goldonline’s trading execution capability and system resilience but also showcases its technological advantages as a global compliant fintech platform. Under the strategic guidance of “regulatory compliance + technological leadership + global layout,” Goldonline is accelerating towards its long-term positioning as a “trusted global financial foundation.”

Media Contact

Company Name: Goldonline Global Ltd

Contact: Grace D. Moran

Website: https://www.maugold.com/, https://goldsinvest.com/

Email: Moran@maugold.com Whetstone@goldsinvest.com

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Stellar

Stellar  Sui

Sui  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Avalanche

Avalanche  Ethena USDe

Ethena USDe  Litecoin

Litecoin  WETH

WETH  LEO Token

LEO Token  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Polkadot

Polkadot  Monero

Monero  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Cronos

Cronos  Pepe

Pepe  Aave

Aave  Ethena

Ethena  Dai

Dai  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Mantle

Mantle  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  OKB

OKB  Pi Network

Pi Network  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Binance-Peg WETH

Binance-Peg WETH  Pudgy Penguins

Pudgy Penguins  USD1

USD1  Algorand

Algorand  Arbitrum

Arbitrum  Gate

Gate  VeChain

VeChain  Bonk

Bonk  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  sUSDS

sUSDS  Story

Story  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Worldcoin

Worldcoin  Sei

Sei  Rocket Pool ETH

Rocket Pool ETH  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Sky

Sky  Filecoin

Filecoin  Lombard Staked BTC

Lombard Staked BTC  SPX6900

SPX6900  Jupiter

Jupiter  USDtb

USDtb  StakeWise Staked ETH

StakeWise Staked ETH  USDT0

USDT0  KuCoin

KuCoin  Liquid Staked ETH

Liquid Staked ETH  Mantle Staked Ether

Mantle Staked Ether  NEXO

NEXO  Injective

Injective  Stacks

Stacks  Curve DAO

Curve DAO  Celestia

Celestia  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Optimism

Optimism  Falcon USD

Falcon USD  Renzo Restaked ETH

Renzo Restaked ETH