Arcadia Finance Suffers $2.5M Exploit on Base; Funds Converted to WETH

Arcadia Finance, a decentralized finance (DeFi) platform operating on the Base blockchain, suffered an exploit resulting in the theft of about $2.5 million in cryptocurrency.

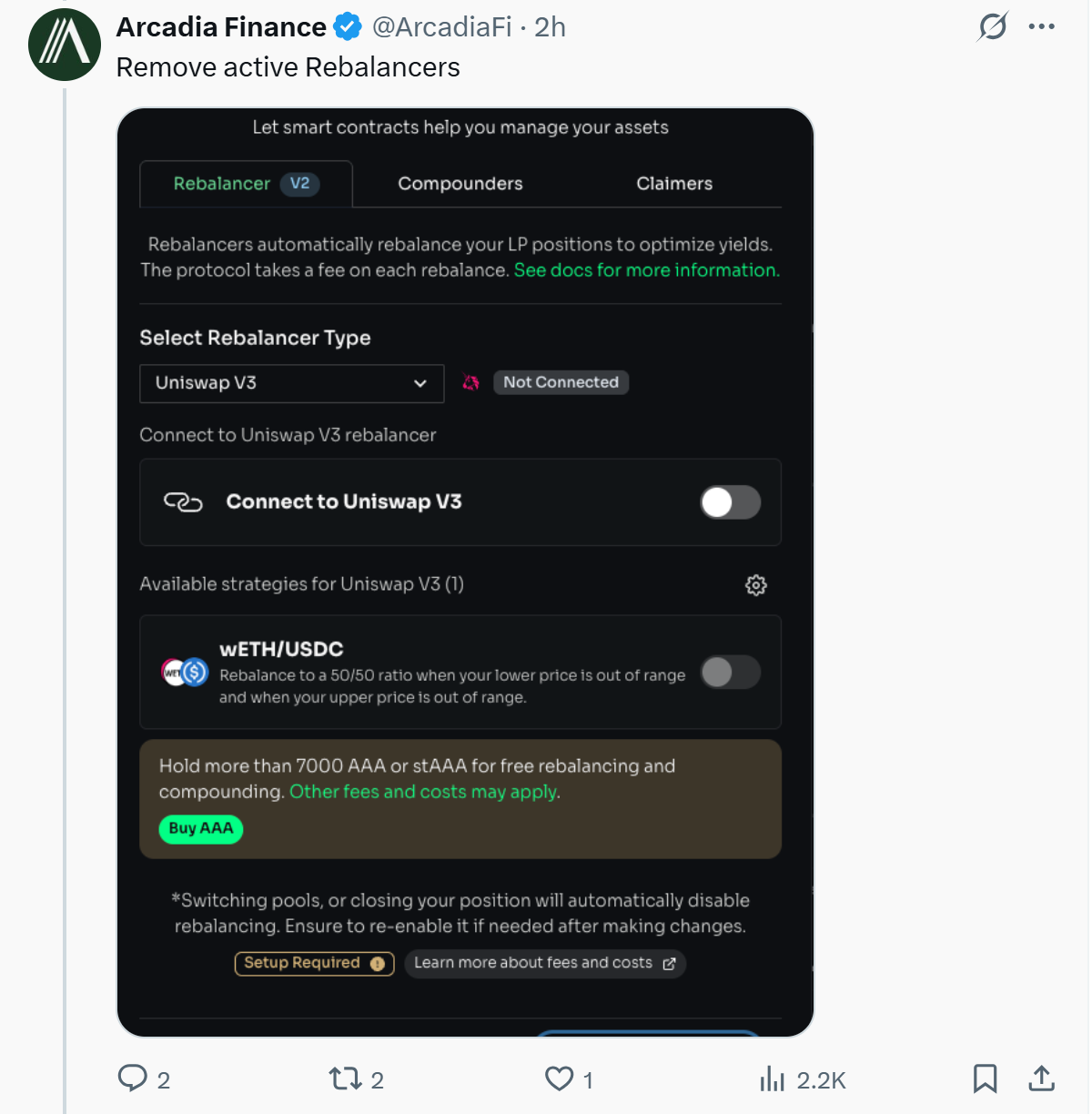

The attacker exploited a vulnerability in Arcadia’s Rebalancer contract by abusing arbitrary swapData parameters, enabling a rogue swap that drained assets from user vaults, according to an alert from blockchain security company Cyvers.

In a report shared with Cointelegraph, Cyvers said the exploit unfolded on Tuesday at 04:05:58 UTC. The attacker deployed a malicious contract and triggered the exploit within a minute. The stolen tokens were then swapped to Wrapped Ethereum (WETH) on the Base network and bridged over to the Ethereum mainnet.

Cyvers flagged that all looted funds resided behind fresh intermediary addresses on Ethereum, indicating an attempt to obfuscate the trail through fragmentation and likely mixing or decentralized exchange (DEX) activity may come soon.

Related: FOMO, lax rules are fueling the crypto crime supercycle

$2.5 million in USDC, USDS stolen

The stolen tokens included about 2.3 million USDC (USDC) and around 227,000 USDS, a $2.5 million loss. The attacker received 199 WETH and 965.8 million AERO tokens during the swap process, across 12 impacted addresses.

Cyvers recommended blacklisting the involved addresses on both Base and Ethereum, notifying major exchanges and bridges to halt inbound transactions and sharing suspicious activity reports with law enforcement.

In a Tuesday post on X, the Arcadia Finance team confirmed the exploit. “The team is aware of unauthorized transactions via a Rebalancer. Remove all permissions for asset managers. More information will follow,” the team said.

They asked users to revoke any permissions granted to rebalancers within Arcadia’s platform to minimize further risk.

Related: Hacker returns stolen funds from $40M GMX exploit

$2.47 billion stolen in first half of 2025

The first half of 2025 has seen more than $2.47 billion in losses due to hacks, scams and exploits, representing a nearly 3% increase over the $2.4 billion stolen in 2024.

More than $800 million was lost across 144 incidents in Q2, a 52% decrease in value lost compared to the previous quarter, with 59 fewer hacking incidents, CertiK said in a report earlier this month.

Cointelegraph has reached out to Arcadia and will update this piece should we hear back.

Magazine: Coinbase hack shows the law probably won’t protect you — Here’s why

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Sui

Sui  Stellar

Stellar  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Avalanche

Avalanche  Ethena USDe

Ethena USDe  Toncoin

Toncoin  LEO Token

LEO Token  Litecoin

Litecoin  WETH

WETH  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Pepe

Pepe  Cronos

Cronos  Aave

Aave  Dai

Dai  Ethena

Ethena  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Aptos

Aptos  OKB

OKB  Pi Network

Pi Network  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  USD1

USD1  Pudgy Penguins

Pudgy Penguins  Binance-Peg WETH

Binance-Peg WETH  Gate

Gate  Algorand

Algorand  Bonk

Bonk  Arbitrum

Arbitrum  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Render

Render  sUSDS

sUSDS  Story

Story  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Sky

Sky  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Rocket Pool ETH

Rocket Pool ETH  Sei

Sei  Lombard Staked BTC

Lombard Staked BTC  Filecoin

Filecoin  Quant

Quant  USDtb

USDtb  SPX6900

SPX6900  USDT0

USDT0  Jupiter

Jupiter  KuCoin

KuCoin  StakeWise Staked ETH

StakeWise Staked ETH  NEXO

NEXO  Liquid Staked ETH

Liquid Staked ETH  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Stacks

Stacks  Injective

Injective  Falcon USD

Falcon USD  Celestia

Celestia  Solv Protocol BTC

Solv Protocol BTC