Ether Hits $4,000 Again As Bitcoin Crypto Market Cap Dominance Dives

Key points:

-

Ether hits $4,000 for the first time since December 2024 in a key milestone for the year.

-

ETH price optimism continues with Ether taking chunks away from Bitcoin’s crypto market cap dominance.

-

BTC could still stage a fresh but short-lived rebound, analysis says.

Ether (ETH) returned to $4,000 for the first time in eight months Friday as Bitcoin (BTC) shed its crypto market cap share.

Ether in “reaccumulation zone” as bulls surge to $4,000

Data from Cointelegraph Markets Pro and TradingView showed ETH/USD reaching $4,012 on Bitstamp.

Gaining around 1.7% on the day, the pair made history for 2025 by breaching the key psychological level, now under $900 from new all-time highs.

🔥 NOW: $ETH back at $4,000. pic.twitter.com/LorYt6ZgSr

— Cointelegraph (@Cointelegraph) August 8, 2025

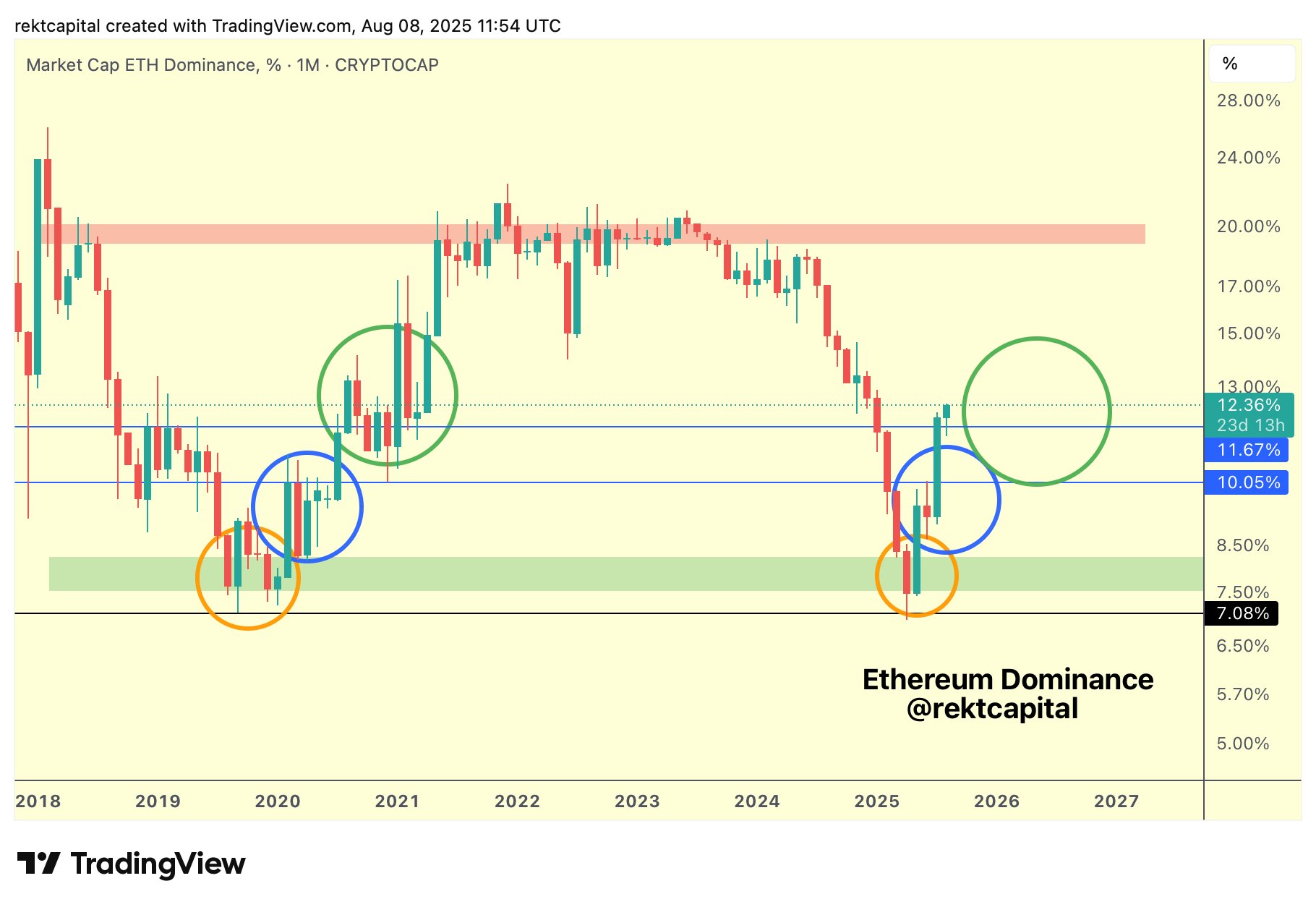

Reacting, popular trader and analyst Rekt Capital was among those eyeing Ether’s increasing slice of the total crypto market cap.

“Ethereum Dominance is already ~50-60% of the way in its Macro Uptrend,” he calculated in an X post.

An accompanying chart compared current price action to the previous ETH bull run through 2021.

Others noted the ongoing investor preference for Ether over BTC, with popular trader Cas Abbe summarizing recent large-scale purchases.

$ETH continues to outperform $BTC 🚀

Just today, a whale bought 10.4K ETH worth $40.5 million via OTC.

Yesterday, Fundamental Global Inc filed a $5 billion shelf offering to buy more ETH.

It feels like the $4K ETH resistance won’t be there for long. pic.twitter.com/Zjsw1xhStS

— Cas Abbé (@cas_abbe) August 8, 2025

Analytics resource Lookonchain meanwhile tracked whale transactions, seemingly aiming to capitalize on Ether’s relative strength.

As $ETH broke through $4,000, whale 0xaf6c just bought 1,390 $WETH($5.56M) at $4,000.

He then deposited this 1,390 $WETH into Aave, borrowed 52.83 $WBTC($6.17M) from #Aave, and swapped it for 1,539 $WETH($6.17M).https://t.co/kvuHUiE6C2 pic.twitter.com/8lAwv4BA3F

— Lookonchain (@lookonchain) August 8, 2025

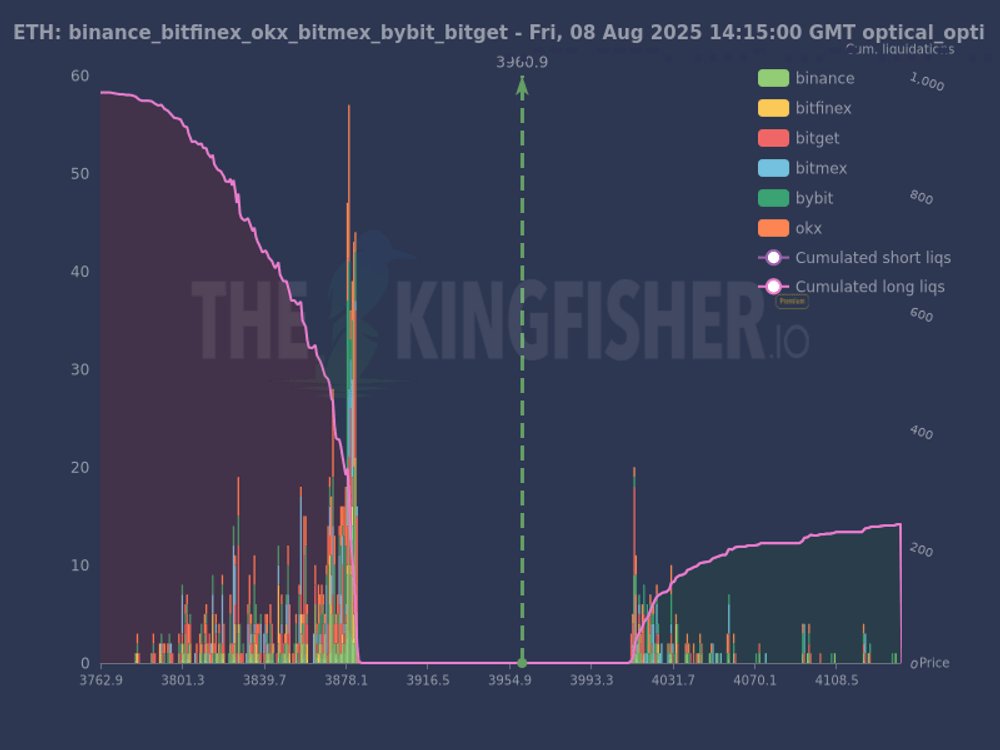

Exchange order book data, featuring a “massive wall of long liquidations” beneath $3,960 meanwhile got X account TheKingfisher primed for further ETH price upside.

“This is what smart money hunts,” part of accompanying X commentary read.

“Most traders see a dump, we see a re-accumulation zone waiting to get fueled.”

Bitcoin dominance faces “inevitable” decline

The moves feed into an existing struggle for supremacy from altcoins, which has seen Bitcoin’s market cap dominance slide rapidly.

Related: Bitcoin Energy Value metric says ‘fair’ BTC price is as much as $167K

Bitcoin’s share fell below 60.7% on the day, again dicing with a critical support level.

In further X analysis, Rekt Capital said that while dominance could still rebound to traditional peak levels around 70%, its eventual breakdown was “inevitable.”

“And once that long-term technical uptrend is lost, BTC Dominance will transition into a long-term technical downtrend,” he forecast.

“And the long-term downside target would be a crash down into the low ~40%, maybe high 30% region.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Stellar

Stellar  Sui

Sui  Wrapped eETH

Wrapped eETH  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Ethena USDe

Ethena USDe  WETH

WETH  Avalanche

Avalanche  Litecoin

Litecoin  Toncoin

Toncoin  LEO Token

LEO Token  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Polkadot

Polkadot  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Monero

Monero  Pepe

Pepe  Ethena

Ethena  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  Mantle

Mantle  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Pi Network

Pi Network  Aptos

Aptos  Internet Computer

Internet Computer  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Pudgy Penguins

Pudgy Penguins  Arbitrum

Arbitrum  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Algorand

Algorand  USD1

USD1  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Bonk

Bonk  Gate

Gate  Render

Render  Rocket Pool ETH

Rocket Pool ETH  Story

Story  Worldcoin

Worldcoin  sUSDS

sUSDS  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Sei

Sei  Sky

Sky  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Filecoin

Filecoin  SPX6900

SPX6900  Quant

Quant  Lombard Staked BTC

Lombard Staked BTC  StakeWise Staked ETH

StakeWise Staked ETH  Jupiter

Jupiter  Mantle Staked Ether

Mantle Staked Ether  Liquid Staked ETH

Liquid Staked ETH  KuCoin

KuCoin  USDtb

USDtb  Injective

Injective  USDT0

USDT0  NEXO

NEXO  Optimism

Optimism  Curve DAO

Curve DAO  Stacks

Stacks  Celestia

Celestia  Falcon USD

Falcon USD  Tether Gold

Tether Gold