SharpLink Buys $54M in ETH, Holdings Reach $1.65B

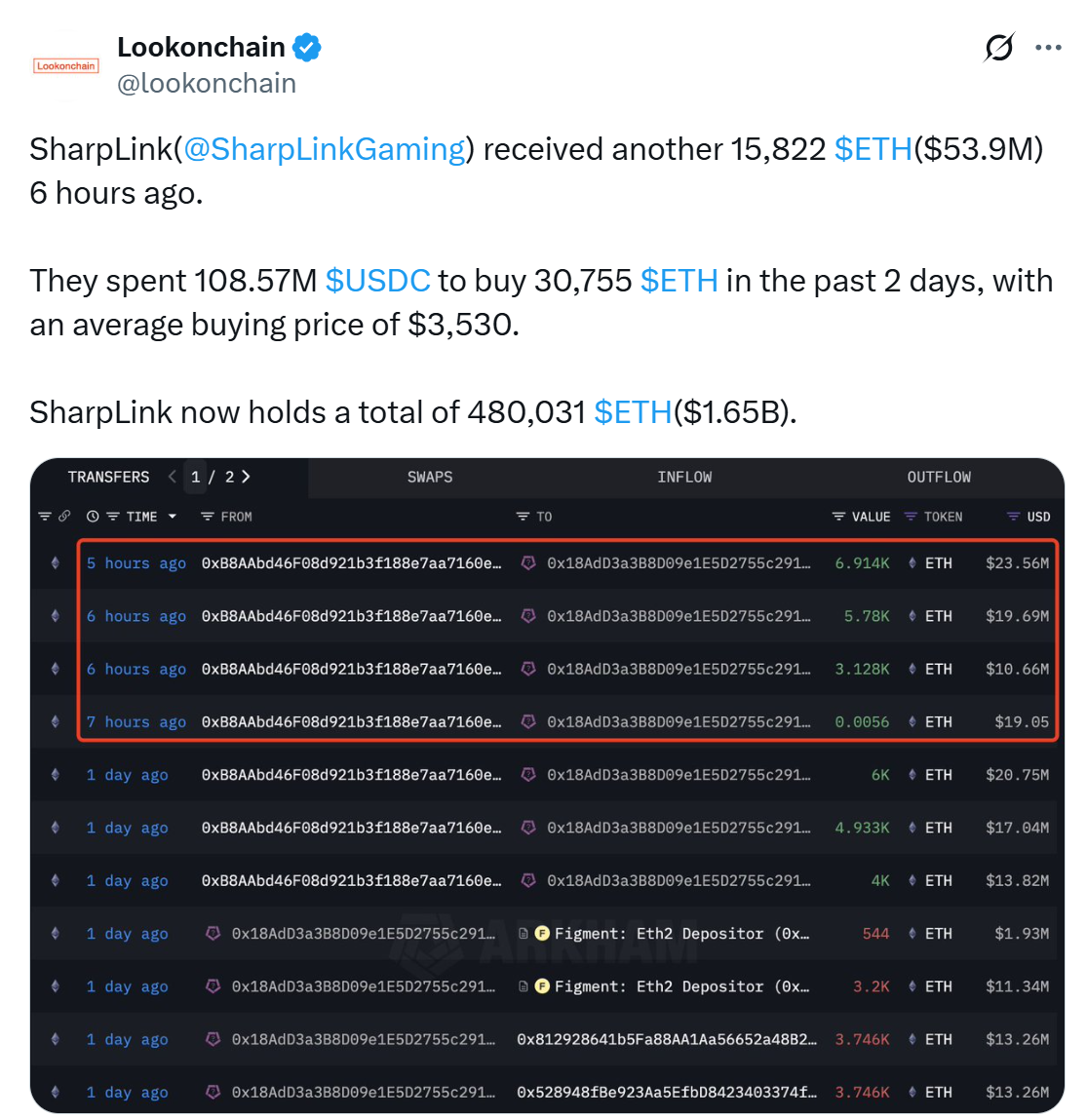

SharpLink has continued its aggressive accumulation of Ether, adding another 15,822 ETH, worth approximately $53.9 million, over the past several hours, according to onchain data.

The purchases were split across multiple transactions, with the largest single transfer totaling 6,914 Ether (ETH), valued at $23.56 million, according to data from Arkham Intelligence.

The new haul brings SharpLink’s total ETH holdings to 480,031 ETH, worth around $1.65 billion at current prices. The buying spree has been ongoing over the past 48 hours, during which the company spent $108.57 million in USDC to acquire 30,755 ETH at an average price of $3,530.

On Thursday, SharpLink also spent $43.09 million USDC (USDC) to purchase 11,259 ETH at an average price of $3,828, according to onchain data.

Related: ETH recovery outpaces Bitcoin despite constant selling at $4K: Here’s why

The Ether Machine buys $57M in ETH

Last week, The Ether Machine added 15,000 ETH to its treasury in a $56.9 million purchase. The acquisition, made at an average price of $3,809 per ETH, coincided with Ethereum’s 10th anniversary.

With the latest move, The Ether Machine’s holdings rise to 334,757 ETH, surpassing the Ethereum Foundation’s 234,000 ETH. The firm now ranks as the third-largest corporate ETH holder, behind only BitMine and SharpLink, according to StrategicETHReserve.

Formed earlier this year through a merger with Nasdaq-listed Dynamix Corp., Ether Machine is targeting a $1.6 billion raise and plans to go public under the ticker ETHM later this year.

Related: Ethereum 2035: How the Next 10 Years Might Look

Corporations bet big on Ethereum as treasury

Corporations are accelerating their Ether purchases, viewing the network as essential infrastructure for the digital economy, according to NoOnes CEO Ray Youssef.

Youssef described Ethereum as a “hybrid between tech equity and digital currency,” increasingly appealing to treasury strategists focused on utility, not just passive storage.

Youssef said ETH’s staking yield, programmability, and regulatory alignment are drawing forward-looking companies. Ethereum currently hosts the majority of tokenized assets and stablecoins, commanding 58.1% of the $13.4 billion real-world asset market.

With its growing dominance and enterprise use cases, Ethereum is fast becoming the reserve currency of choice for companies operating in tokenized finance.

Magazine: Dummies’ guide: Ethereum’s roadmap to 10,000 TPS using ZK tech

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Stellar

Stellar  Sui

Sui  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Toncoin

Toncoin  Litecoin

Litecoin  LEO Token

LEO Token  WETH

WETH  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Polkadot

Polkadot  Monero

Monero  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Pepe

Pepe  Cronos

Cronos  Aave

Aave  Dai

Dai  Ethena

Ethena  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Aptos

Aptos  Pi Network

Pi Network  OKB

OKB  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  USD1

USD1  Pudgy Penguins

Pudgy Penguins  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Bonk

Bonk  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  Story

Story  Render

Render  POL (ex-MATIC)

POL (ex-MATIC)  sUSDS

sUSDS  Worldcoin

Worldcoin  Official Trump

Official Trump  Binance Staked SOL

Binance Staked SOL  Sky

Sky  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Rocket Pool ETH

Rocket Pool ETH  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Sei

Sei  Quant

Quant  Filecoin

Filecoin  Lombard Staked BTC

Lombard Staked BTC  SPX6900

SPX6900  USDtb

USDtb  Jupiter

Jupiter  USDT0

USDT0  KuCoin

KuCoin  StakeWise Staked ETH

StakeWise Staked ETH  NEXO

NEXO  Liquid Staked ETH

Liquid Staked ETH  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  Injective

Injective  Stacks

Stacks  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Celestia

Celestia  Falcon USD

Falcon USD  Renzo Restaked ETH

Renzo Restaked ETH