Warren Buffett Misses $850M in Bitcoin Gains by Sticking to Cash in H1 2025

Key takeaways:

Berkshire Hathaway has posted a headline profit of $12.3 billion in the second quarter of 2025, according to its latest filings. A closer look reveals a rougher story, however, especially when it comes to missed hedging opportunities from ignoring Bitcoin (BTC).

Bitcoin could’ve softened Berkshire’s $4.60 billion equity loss

The Warren Buffett-led conglomerate took a massive $5 billion impairment hit on its Kraft Heinz stake during the quarter, contributing to $4.60 billion in equity method investment losses for the year’s first half.

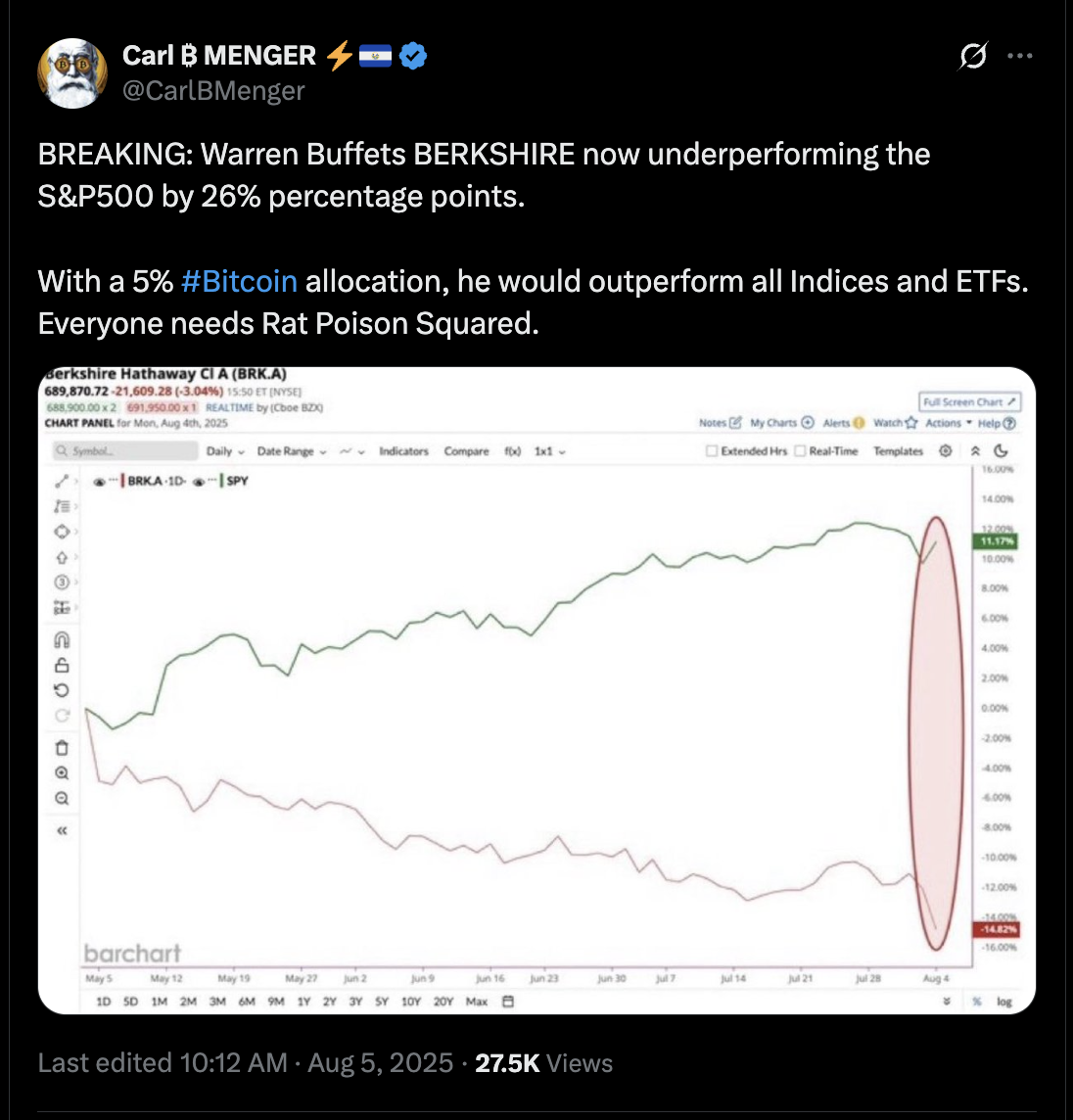

Net earnings are down sharply from the same period last year, and the firm’s stock has lagged behind both Bitcoin and the S&P 500 in 2025, especially after Buffett announced that he would step down from the CEO position.

As of Aug. 5, Berkshire shares are up just 3.55% year-to-date. By contrast, the S&P 500 has gained 7.51%, while Bitcoin is up 16.85%.

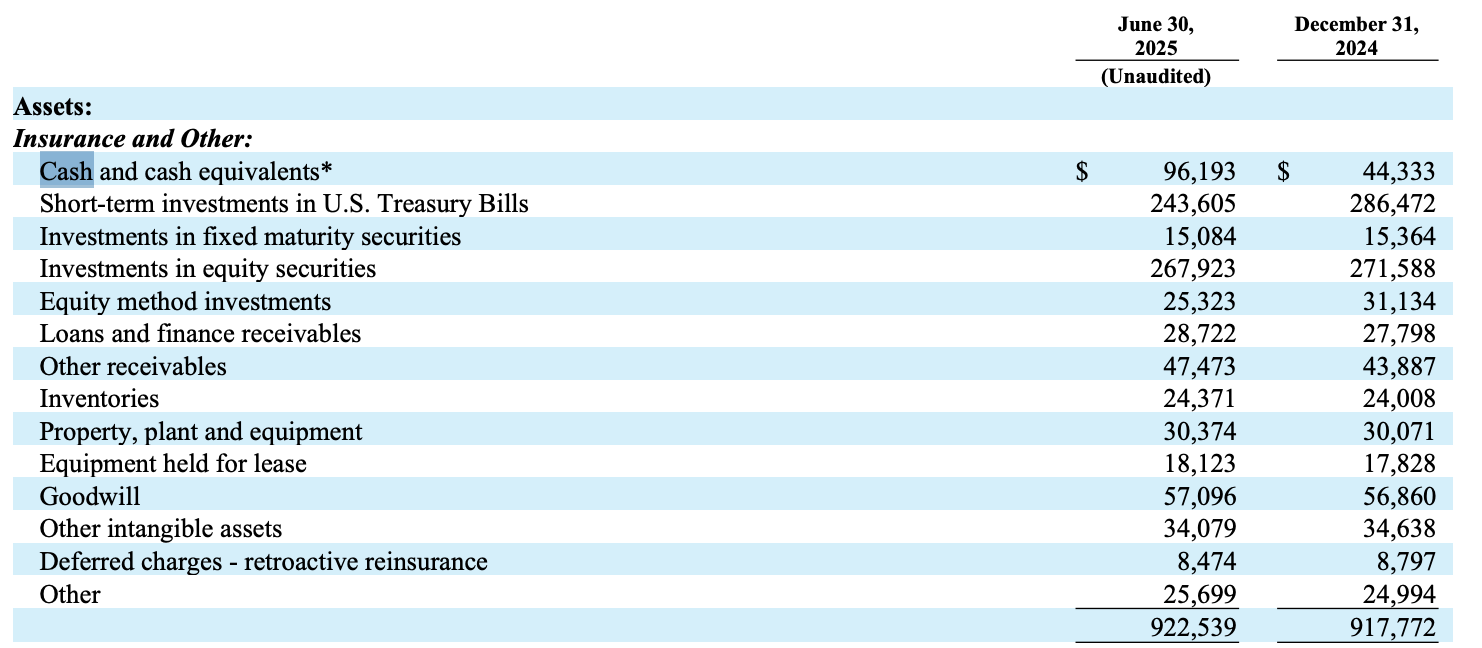

Berkshire held $100.49 billion in cash and cash equivalents at the end of June, most of it parked in short-term Treasury bills and low-yield instruments.

If just 5% of that capital had been allocated to Bitcoin at the beginning of 2025, it would have delivered over $850 million in unrealized gains by August, based on BTC’s 16.85% year-to-date return.

That hypothetical Bitcoin gain wouldn’t have erased the Kraft Heinz shortfall but would have meaningfully offset the loss.

Related: How much Bitcoin can Berkshire Hathaway buy?

It also would’ve given Berkshire more flexibility since the firm hasn’t conducted stock buybacks in the first half of the year.

BTC beats Berkshire’s top holdings in 2025

The missed BTC gains put into perspective just how much Berkshire’s conservative approach has cost in relative performance.

For instance, the cryptocurrency has outperformed Berkshire’s top three stock holdings—Apple (AAPL), American Express (AXP), and Coca-Cola (KO)—so far in 2025, as shown below.

The irony is that Buffett has long dismissed Bitcoin as “rat poison squared.” He’s repeatedly said that Bitcoin produces no yield, has no intrinsic value, and does not belong in any investment portfolio.

And yet, Bitcoin has outperformed Berkshire’s top holdings in a year defined by rising ETF inflows, institutional adoption, and a macro backdrop that has increasingly favored hard assets.

Related: Bitcoin ETF inflows show institutions ‘doubled down’ on BTC at $116K

Buffett’s successor, Berkshire’s new CEO Greg Abel, has so far offered no public statements supporting Bitcoin or any crypto.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Stellar

Stellar  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Litecoin

Litecoin  WETH

WETH  LEO Token

LEO Token  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Polkadot

Polkadot  Monero

Monero  Bitget Token

Bitget Token  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Pepe

Pepe  Aave

Aave  Ethena

Ethena  Dai

Dai  Bittensor

Bittensor  Mantle

Mantle  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Aptos

Aptos  OKB

OKB  Internet Computer

Internet Computer  Pi Network

Pi Network  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Binance-Peg WETH

Binance-Peg WETH  USD1

USD1  Pudgy Penguins

Pudgy Penguins  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  sUSDS

sUSDS  POL (ex-MATIC)

POL (ex-MATIC)  Bonk

Bonk  Render

Render  Story

Story  Official Trump

Official Trump  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Binance Staked SOL

Binance Staked SOL  Rocket Pool ETH

Rocket Pool ETH  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Sei

Sei  Sky

Sky  Lombard Staked BTC

Lombard Staked BTC  Filecoin

Filecoin  Quant

Quant  SPX6900

SPX6900  USDtb

USDtb  Jupiter

Jupiter  USDT0

USDT0  StakeWise Staked ETH

StakeWise Staked ETH  KuCoin

KuCoin  Mantle Staked Ether

Mantle Staked Ether  Liquid Staked ETH

Liquid Staked ETH  NEXO

NEXO  Injective

Injective  Curve DAO

Curve DAO  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Stacks

Stacks  Falcon USD

Falcon USD  Celestia

Celestia  Renzo Restaked ETH

Renzo Restaked ETH