Secure Multiparty Computation Market Supported by Advancements in Cryptographic Protocols and Regulatory Compliance

Secure Multiparty Computation (SMPC) Market

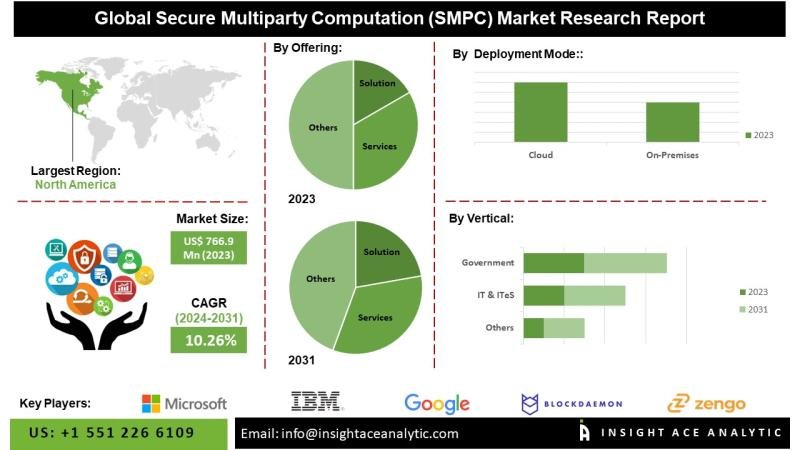

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Secure Multiparty Computation (SMPC) Market – (By Offering (Solution, Services), By Deployment Mode (Cloud, On-Premises), By Vertical (Banking, Financial Services, and Insurance (BFSI), IT & ITeS, Government, Healthcare, Retail and eCommerce)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031.”

According to the latest research by InsightAce Analytic, the Global Secure Multiparty Computation (SMPC) Market is valued at US$ 766.9 Mn in 2023, and it is expected to reach US$ 1,642.8 Mn by 2031, with a CAGR of 10.26% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2572

Secure Multiparty Computation (SMPC) is an advanced cryptographic protocol that enables multiple entities to collaboratively compute a function over their respective private inputs, without revealing the underlying data to one another. This ensures that each participant maintains full confidentiality and control over their sensitive information while facilitating secure joint computation.

The growth of the SMPC market is largely attributed to the rising demand for secure key management solutions and increased emphasis on regulatory compliance concerning data privacy. Organizations are increasingly turning to SMPC technologies to strengthen data protection mechanisms and enhance operational security, particularly in light of growing concerns around cyber threats and regulatory mandates. The integration of emerging technologies such as artificial intelligence (AI), machine learning (ML), and blockchain into SMPC architectures is further catalyzing market development by enabling more secure, efficient, and scalable computational environments.

Recent innovations in AI and cryptographic methods have significantly enhanced the performance and scalability of SMPC solutions, making them suitable for processing large-scale datasets and executing complex computations. The synergy between AI and SMPC is improving the accessibility of these technologies, enabling their adoption across diverse organizational sizes and industry verticals.

Key sectors such as finance, healthcare, and government are increasingly leveraging SMPC to implement privacy-preserving data analytics, thereby addressing critical issues around data breaches and regulatory compliance. Despite these advancements, the market faces ongoing challenges including performance optimization, broader adoption, and the need for standardized implementation protocols to support interoperability and long-term scalability.

List of Prominent Players in the Secure Multiparty Computation (SMPC) Market:

• Microsoft

• IBM

• Google

• Fireblocks

• Blockdaemon

• Qredo

• Penta Security

• Zengo

• CYBAVO

• Liminal Custody

• Spatium

• Sharemind

• Atato

• Web3Auth

• Patricia Blockchain

• Orochi Network

• Binance

• Pyte

• Roseman Labs

• MPCVault

• DuoKey

• Linksight

• HyperBC

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics

Drivers:

The Secure Multiparty Computation (SMPC) market is experiencing robust growth, primarily driven by increasing concerns over data privacy, the enforcement of stringent regulatory compliance standards, and a rising need for secure data collaboration across industries. SMPC technology enables multiple entities to perform joint computations on confidential datasets without exposing individual inputs, thereby significantly enhancing data security and confidentiality.

The growing prevalence of cyber threats and data breaches further amplifies the demand for SMPC solutions. Additionally, continuous advancements in cryptographic techniques and the expanding implementation of SMPC in sectors such as financial services, healthcare, and research are catalyzing market expansion by enabling secure and privacy-preserving analytics across diverse use cases.

Challenges:

Despite its promise, the SMPC market faces notable challenges that may hinder widespread adoption. A key concern is achieving an optimal balance between computational performance and security; highly secure protocols often introduce latency, which can be a barrier in environments requiring real-time processing. Moreover, the inherent complexity of SMPC protocols can impede usability for non-specialist users, limiting accessibility and scalability. Technical difficulties also arise in ensuring interoperability across varied SMPC frameworks. As the cybersecurity landscape continues to evolve, persistent vulnerabilities and sophisticated threats necessitate ongoing innovation and updates to SMPC solutions to uphold robust security standards.

Regional Trends:

The Asia-Pacific region is witnessing rapid adoption of SMPC technologies, driven by accelerated digitalization and increased focus on data security across industries such as finance, healthcare, and public services. However, the region also faces challenges, including technical limitations related to protocol scalability, complexity, and a shortage of skilled professionals proficient in SMPC. Furthermore, regulatory fragmentation across jurisdictions requires region-specific compliance strategies, adding complexity to market entry and growth. In contrast, Europe represents a well-established market, bolstered by a strong regulatory framework and strategic investments by key industry players in cryptographic innovation. Globally, the SMPC market is poised for continued growth, supported by cross-regional collaborations and strategic initiatives aimed at expanding operational footprints and technological capabilities.

Recent Developments:

• In Apr 2024, Fireblocks added two new security features to its DeFi suite: dApp Protection and Transaction Simulation. Given the remarkable expansion of the DeFi industry, it has become increasingly crucial to implement proactive security measures. Fireblocks introduced new security enhancements in response to attackers leveraging the technical and opaque properties of DeFi. These features enhance the capabilities of institutional firms by offering real-time identification of threats, providing clear understanding of contract calls, and implementing preventive actions against hostile activity.

• In October 2022, an enterprise-ready privacy-enhanced data collaboration platform was released by Duality Technologies, the industry leader in secure data collaboration for businesses. It allows businesses to exchange and collaboratively analyze sensitive data while maintaining privacy and regulatory compliance. To calculate data without revealing it, Duality easily interacts with OpenFHE, the top open-source fully homomorphic encryption library. These consist of differential privacy, federated learning, multiparty computation, completely homomorphic encryption, and more.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2572

Segmentation of Secure Multiparty Computation (SMPC) Market-

By Offering:

• Solution

• Services

By Deployment Mode:

• Cloud

• On-Premises

By Vertical:

• Banking, Financial Services, and Insurance (BFSI)

• IT & ITeS

• Government

• Healthcare

• Retail and eCommerce

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/secure-multiparty-computation-smpc-market/2572

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: http://www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Hyperliquid

Hyperliquid  Sui

Sui  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Avalanche

Avalanche  Litecoin

Litecoin  LEO Token

LEO Token  WETH

WETH  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Monero

Monero  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Bitget Token

Bitget Token  Pepe

Pepe  Cronos

Cronos  Aave

Aave  Ethena

Ethena  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  OKB

OKB  Pi Network

Pi Network  Mantle

Mantle  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Pudgy Penguins

Pudgy Penguins  Binance-Peg WETH

Binance-Peg WETH  USD1

USD1  Algorand

Algorand  Bonk

Bonk  Arbitrum

Arbitrum  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Render

Render  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  sUSDS

sUSDS  Official Trump

Official Trump  Story

Story  Binance Staked SOL

Binance Staked SOL  Sky

Sky  Rocket Pool ETH

Rocket Pool ETH  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Sei

Sei  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Filecoin

Filecoin  Quant

Quant  SPX6900

SPX6900  Lombard Staked BTC

Lombard Staked BTC  Jupiter

Jupiter  USDtb

USDtb  StakeWise Staked ETH

StakeWise Staked ETH  USDT0

USDT0  KuCoin

KuCoin  NEXO

NEXO  Liquid Staked ETH

Liquid Staked ETH  Injective

Injective  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Stacks

Stacks  Celestia

Celestia  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Renzo Restaked ETH

Renzo Restaked ETH  Falcon USD

Falcon USD